Amazon leads in online grocery shopper satisfaction

Supermarkets garner highest percentage of new online customers, Retail Feedback Group study finds.

July 13, 2020

Amazon leads in customer satisfaction among online grocery shoppers, while traditional supermarkets have seen the biggest gain in online shopping use versus a year ago, according to the 2020 U.S. Online and In-Store Grocery Shopping Study from Retail Feedback Group (RFG).

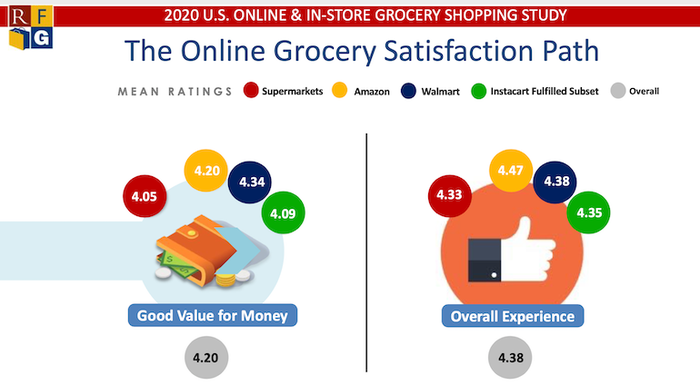

On a scale of 1 to 5, Amazon scored 4.47 in online grocery customer satisfaction, putting the e-tail giant just ahead of Walmart at 4.38, reported RFG, which polled 2,000 grocery shoppers (split evenly between online and in-store visitors) in late April to early May. Supermarkets and food stores rated at 4.33 for their online shopping experience, below the overall satisfaction score of 4.38. Instacart-fulfilled service earned a score of 4.35.

Though still high, this year’s online grocery satisfaction ratings are down from RFG’s 2019 study, when the overall customer rating was 4.48, with scores of 4.60 for Amazon, 4.45 for Walmart, 4.43 for supermarkets/food stores and 4.48 for Instacart.

In-stock conditions and order turnaround were chief concerns of online grocery shoppers, especially in the wake of the COVID-19 outbreak, RFG’s research showed. Just over half (51%) of those surveyed said their online retailer/service had everything in stock that they wanted to buy, while 49% said that wasn’t the case. For those encountering out-of-stocks, only 17% were able to purchase acceptable substitutions for all unavailable items. Fifty percent were able to procure acceptable substitutions for some not-in-stock items, and 33% found no such substitutions.

Meanwhile, 45% of respondents reported not receiving all items ordered online. Supermarkets saw the highest percentage of customers not getting everything they ordered (52%), followed by Walmart (45%) and Amazon (31%). RFG’s 2020 study noted that these figures are “massively higher” versus a year ago because of the pandemic’s supply chain disruptions. In the 2019 study, just 5% of online grocery shoppers didn’t receive all items ordered, with those percentages at 8% for supermarkets, 5% for Walmart and 3% for Amazon.

On the 1-to-5 scale, consumers rated online grocery providers at 3.68 overall for having the items they wanted in stock, led by Amazon at 4.02 and followed by Walmart (3.73), Instacart (3.70) and supermarkets (3.51).

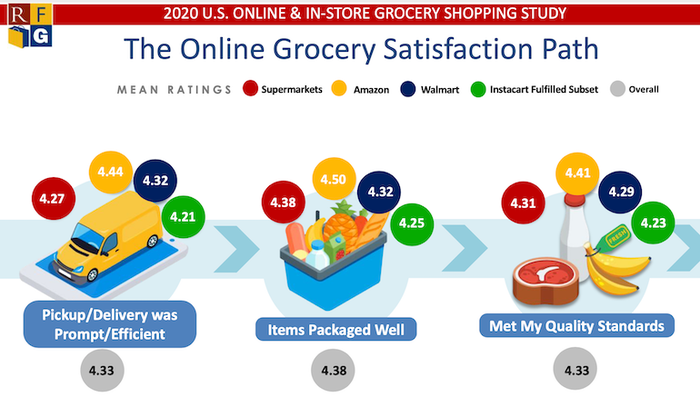

Online grocery shoppers expressed more satisfaction with pickup and delivery, with 92% saying they received their order on time once they were able to obtain a delivery window. Respondents rated the availability of convenient pickup/delivery times at 4.22, with scores of 4.32 for Amazon, 4.21 for both Walmart and Instacart, and 4.15 for supermarkets. In terms of prompt and efficient pickup/delivery, consumers surveyed rated their experience at 4.33, led by Amazon at 4.44 and followed by Walmart (4.32), supermarkets (4.27) and Instacart (4.21). Online customers gave overall scores of 4.38 for items packaged well and 4.33 for items meeting their quality standards, with all online grocery providers earning good ratings in those areas.

In RFG’s study, Amazon achieved the highest score in virtually areas of online grocery customer satisfaction, which also included easy navigation to desired products, smooth website/app performance and checkout process, and easy-to-find and -apply discounts. Walmart led in its online grocery service being a good value for the money, with a score of 4.34 versus 4.20 for Amazon, 4.09 for Instacart and 4.05 for supermarkets. Overall, survey respondents rated their online grocery experience at 4.20 in terms of being a good value for the money.

“Considering the sudden, sizable pressure on online grocery shopping during the pandemic, it is noteworthy overall satisfaction registered as high as it did,” noted Brian Numainville, principal at Lake Success, New York-based consumer research firm RFG.

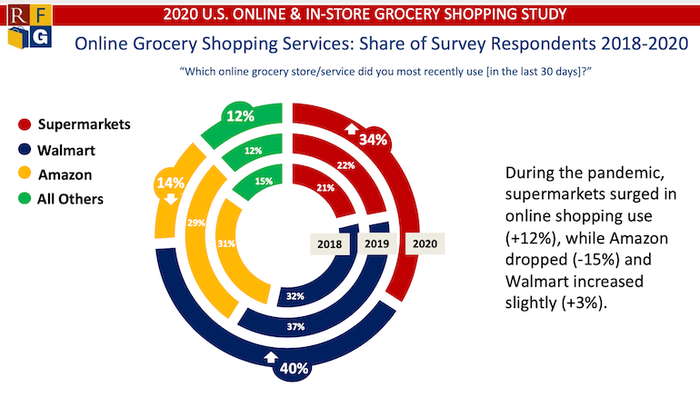

When asked which online grocery retailer or service they used in the past 30 days, 40% of respondents in RFG’s 2020 study cited Walmart, which was up slightly from 37% in 2019. However, supermarkets saw the biggest gain in online shopping usage at 34%, up from 22% in 2019. That percentage fell to 14% from 29% last year for Amazon, while all other providers saw their share hold steady at 12%.

Overall, 36% of consumers surveyed by RFG this year said they were first-time online shoppers. That percentage was highest for supermarkets/food stores (17%), compared with 13% apiece for Walmart and Amazon. The latter two providers led in terms of frequency, with 55% of Amazon and 51% of Walmart online grocery shoppers saying they’ve used the service more than five times in the past 30 days, versus 43% for supermarkets/food stores.

Within the last three months, 19% of respondents said tried or shopped three online grocery providers, while 34% used two providers. Another 5% tried or shopped four online grocery providers, and 4% used five or more.

Of respondents’ online grocery orders, 51% were fulfilled via pickup (47% in 2019), and 49% were fulfilled by delivery (53% in 2019). The percentage of orders/deliveries handled by Instacart rose to 36% in the 2020 study from 27% a year earlier.

Forty-six percent of consumers said they to buy groceries online more often in the next 12 months, up 41% in the 2019 study, RFG said. Meanwhile, 37% reported that their online grocery purchases will be about the same (54% in 2019), and 17% said they’ll shop for groceries online less often — up from 4% in 2019.

Amazon stands to see the largest increase in online grocery purchases in the next 12 months, with 52% of shoppers saying they’ll do more food shopping with Amazon, compared with 46% for Walmart and 44% for supermarkets. The percentage of customers reporting they’ll buy groceries online less often rose for all providers, led by supermarkets at 20% (5% in 2019), Walmart at 16% (3% in 2019) and 13% for Amazon (5% in 2019).

“Although supermarkets surged in online shopping use, and many customers may stick, the results show some supermarket shoppers don’t expect to continue online shopping,” Numainville added. “With that in mind, it will be important that supermarkets and online service providers maximize their investment by continually strengthening their offerings in order to retain existing customers, while attracting new ones, along with preparing for any future situations.”

This piece originally appeared on Supermarket News, a New Hope Network sister website. Visit the site for more grocery trends and insights.

This piece originally appeared on Supermarket News, a New Hope Network sister website. Visit the site for more grocery trends and insights.

About the Author

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)