Teamsters urge 'no' vote on proposed UNFI executive pay package

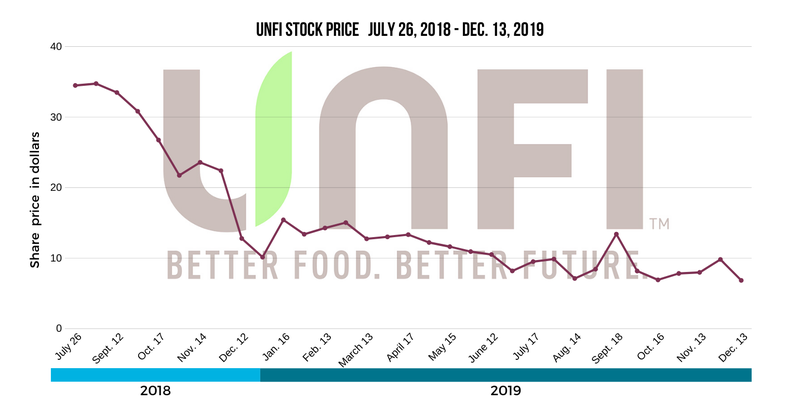

CEO Steve Spinner up for a 65% bonus even though food distributor's stock has fallen 80% since Supervalu deal closed.

The International Brotherhood of Teamsters doesn't want United Natural Foods Inc. to reward its executives with double-digit pay raises since the company's stock spiraled downward over the past 16 months.

The Teamsters' main argument centers on UNFI's dramatic fall in value since the company announced its plan to acquire rival food distributor Supervalu.

Before the acquisition, UNFI was valued at about $2.2 billion, according to the Teamsters. Now, however, its market capitalization is less than half a billion, the union says. At the end of November, SimplyWall.st reported UNFI's market capitalization at $465 million.

"Even as management has succeeded in destroying billions of dollars in shareholder value, the Compensation Committee…has taken numerous steps to cushion the financial blow to CEO Steven Spinner" and Chief Operations Officer Sean Griffin, the Teamsters wrote in a November letter to shareholders.

Shareholders will vote on the compensation plan during Wednesday's annual meeting, but their decision regarding pay is simply advisory.

According to the Compensation Committee's report, Spinners' proposed pay, including incentives, is $7.1 million based on fiscal 2019 results. That's a 39% increase from the $5.1 million he earned a year ago.

Griffin's total pay, as proposed, totals $3.7 million, an increase of 78% from the $2.1 million he earned last year. Before the acquisition, Griffin was the CEO of Supervalu.

UNFI management has deserved higher compensation many years, says Alan Meyers, a senior capital markets adviser or the Teamsters. "This is not that year."

UNFI did not respond to request for comment, but the Compensation Committee's report detailed the process of determining Spinner's base salary and cash incentive.

How the CEO's salary is calculated

Spinner joined UNFI in September 2008 as the company's president and chief executive officer, and become chairman of the board in 2016. The 59-year-old has more than 30 years' experience in food distribution.

Spinner's base salary for fiscal 2019 was increased to $1.2 million, effective Oct. 22, 2018, in part because the addition of Supervalu gave Spinner greater responsibilities.

In general, pay packages for named executives are based on the pay at companies with similar revenue—between $10 billion and $25 billion in UNFI's case, according to the Compensation Committee's report.

"This is one of the reasons shareholders are skeptical of empire-building: Because it pushes the CEOs' pay peers into a different bracket," Pryce-Jones says.

In analyzing companies with market caps of $200 million to $800 million, SimplyWall.st determined the median CEO total compensation was $1.7 million.

Bonuses designed to motivate executives

UNFI's pay packages are designed so executives are motivated to create short-term and long-term stockholder value. Therefore, the CEO's pay is weighted so 85% of his potential pay package—including cash and vesting shares of stock—is determined by the company's financial results.

Originally, Spinner's compensation bonus was to be based half on adjusted EBITDA and half on adjusted EPS, then compared to benchmarks for those measures. If those metrics reached the committee's target, Spinner would receive a bonus equal to 150% of his salary, or $1.75 million.

In September, the Compensation Committee further adjusted both EBITDA and EPS, based on accounting adjustments that did not affect the company's core business, according to the report. The adjusted EBITDA was $588.9 million or 43.49% of target. Similarly, an $80 million adjustment to EPS increased that metric to $2.51 per share, generating a 200% payout. As a result, Spinner would have received a total payout of 121.74%, according to the committee's report.

The committee determined the payout was "not in line with performance," so the members used their discretion to eliminate the EPS portion of the bonus. This decision was made, the committee report states, "for internal equity purposes." EPS was not a factor for the bonuses of the other named executives, including Griffin, according to the committee's report.

But Pryce-Jones and Meyers argue that the committee should have taken the $80 million out of the EPS calculation and proceeded with the 50-50 split. This would have lowered EPS to about $1.28—below the threshold for any bonus based on EPS. Consequently, Spinner's blended bonus payout would have been 21.5% percent of target: $384,272 or 32% of his salary.

Instead, Spinner's payout, based solely on the adjusted EBITDA, was 43% of the target payout: $759,556 or 65% of his base salary. The other executives' payouts were also based on 43% of the EBITDA target, but they had varying levels of compensation tied to the target.

Falling value has been a long-term problem

The Teamsters' letter to shareholders noted that UNFI wasn't a strong investment even before the Supervalu acquisition was announced on July 26, 2018. During the five years prior, the stock fell 40.96%, while the S&P 500 grew 67.73%.

UNFI is "among the worst investments in the United States," the Teamsters' letter stated.

As of Dec. 13, the company's stock has fallen 80.2%, to $6.84 on Friday from $34.48 per share on July 26, 2018. At the same time, the S&P 500 increased 11.7% and the NASDAQ 100 grew 11.2%.

The Teamsters, including its affiliated pension and benefit funds, "have substantial holdings" in UNFI, according to the letter signed by Ken Hall, the union's general secretary-treasurer.

Pryce-Jones and Meyers could not estimate the Teamsters' holdings because the union's money is invested through separate funds, the men said in a phone interview. Neither the international organization nor the locals hold stocks directly, Meyers says.

PDF versions of UNFI's proxy statement (top) and the Teamsters' letter to shareholders (bottom) can be downloaded by clicking here:

About the Author

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)