10,000 dedicated dietary supplement users list top choices

ConsumerLab’s latest survey reveals which supplements, sales channels and retailers are hot—or not. Find out what 10,000 committed consumers say.

April 2, 2024

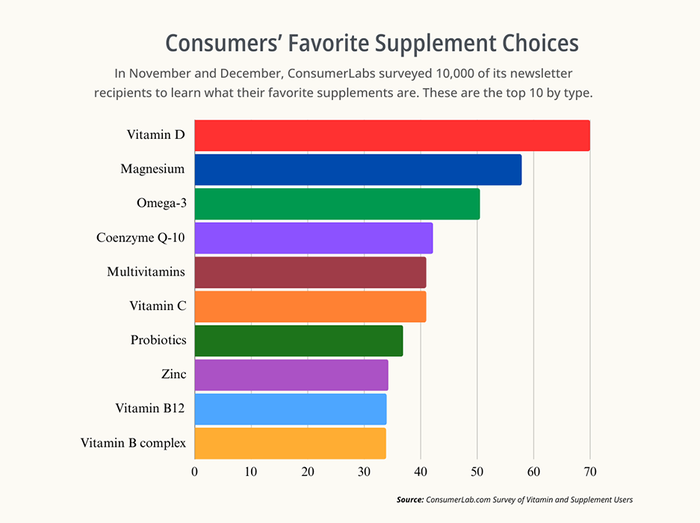

For the ninth year running, vitamin D is far and away the most popular product among active supplement users, with 70% taking the sunshine vitamin regularly. Magnesium once again came in second place, used by 57.9% of supplement shoppers, edging out omega-3 products, purchased by 50.5%.

This new intel comes from the latest ConsumerLab.com Survey of Vitamin and Supplement Users, which polled 10,000 recipients of the company’s newsletter in November and December 2023. ConsumerLab, which conducts independent analyses of wellness products to educate shoppers, recently published its findings in a 170-page report, revealing which types of supplements consumers use most, where they purchase these products and which retailers and brands they like and dislike.

“This report is an excellent and unique way for retailers and brands to get insights into what is currently happening in the marketplace,” says Lisa Sabin, vice president of business development at ConsumerLab.

The survey findings may be particularly pertinent for natural products retailers. Beyond the sheer size of the study population, which dwarfs that of most supplement-usage surveys, the participant pool is also representative of the typical natural products shopper.

“This isn’t just snapshot of the American public,” Sabin says. “These are heavy supplement users, almost 77% of whom use four or more different supplements a day. These are the consumers that supplement retailers and brands really want to target.”

These consumers, which represent diverse ages and genders, are also very influential, Sabin adds. Therefore, it can behoove natural products retailers to understand these shoppers’ preferences and purchasing patterns to serve them better.

Most popular supplements

ConsumerLab’s latest survey evaluated the popularity of more than 200 supplements and functional foods based on respondents’ usage.

Behind vitamin D, magnesium and omega-3s in the top three, coenzyme Q-10 ranked as the fourth most popular supplement, used by 42.2% of consumers. Multivitamins, including prenatal products, finished fifth with 41%, followed by vitamin C (41%), probiotics (36.9%), zinc (34.3%) and vitamin B12 (34%). Vitamin B complex rounded out the top 10, with 33.9% of respondents taking it.

In the next tier, curcumin/turmeric landed in 11th place, used by 33% of survey participants. Next came vitamin K (31%), calcium (28.7%), collagen (28.5%), melatonin (27.6%), protein (24.2%), green tea (23.4%) and cocoa (20.8%). Quercetin and apple cider vinegar tied for 19th most popular products each used by 20.4% of consumers polled.

A few notable supplements cracked the top 50 for the first time in 2023, including nutritional yeast, manuka honey, bioperine, lion’s mane mushrooms and electrolytes.

Supplements trending up and down

Although Sabin says no supplements’ position changed dramatically in 2023, there were some notable increases and decreases that retailers should put on their radars.

Experiencing the greatest absolute growth in popularity, the hormone pregnenolone increased by 7.5%. After that, magnesium jumped 4.8%, trendy berberine climbed 4.3% and taurine moved up 4.2%. Next, PQQ (pyrroloquinoline quinone) grew 4.1%, followed by collagen (3.8%), protein and nutrition powders and drinks (3.6%), vitamin K (3.1%) and lion’s mane mushrooms(3%).

As for the greatest declines in popularity, biotin topped that list, dropping 11% from the 2022 survey. Joint health supplements suffered the next biggest decrease with 6.8%, followed by potassium (-6.4%), probiotics (-6%),& prebiotics (-4.2%) and CBD (-3.4%).

Credit: Alamy

Most popular supplement sales channels

Where do heavy supplements users like to shop for these products? Consistent with the results of the last several years’ surveys, Sabin says the most popular sales channel is once again multicategory online retailers, namely Amazon, with 56% of respondents buying their supplements from these sites. Amazon is also, not surprisingly, the most popular single supplement merchant across all sales channels, with 59% of consumers favoring the e-tail giant.

The second most preferred channel is supplement-focused online sellers such as iHerb, Vitacost and Lucky Vitamin, utilized by 32% of respondents. That channel just barely beat out warehouse clubs (Costco, Sam’s Club, etc.), with just shy of 32% of consumers opting to purchase supplements from the discount megastores.

Favorite retailers by channel

ConsumerLab also assessed overall consumer satisfaction with various supplement merchants. Here are the stores that ranked highest in each sales channel:

Catalog/internet merchant: Swanson.

Grocery store: Trader Joe’s.

Mass-market store: Target.

Online multicategory retailer: Amazon.

Online supplements retailer: Pure Formulas.

Pharmacy: Rite Aid.

Practitioner line merchant: Health care practitioner offices.

Vitamin store: The Vitamin Shoppe.

Warehouse store: Costco.

Notably, natural products stores are missing from this list—but that doesn’t mean consumers are unhappy with their experiences at these stores. Rather, the omission simply reflects the fact that health food stores and natural grocers tend to be local or regional independents, says Sabin. Because of that, it’s tough for any single independent to garner enough critical mass to rank high on a nationwide consumer survey.

Even so, natural products retailers can glean plenty of insights from ConsumerLab’s findings, especially as they fight for market share against intensifying competition.

About the Author

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)