Flowers Foods acquires Simple Mills in $795M deal

The acquisition strengthens Flowers Foods' position in the better-for-you snacking category and expands its portfolio with Simple Mills nutrient-dense product line.

At a Glance

- Flowers Foods Inc. will acquire Simple Mills for $795 in cash.

- The deal is expected to boost Flowers' growth in the better-for-you snack category and diversify its portfolio.

- Simple Mills will remain an independent subsidiary, led by founder Kaitlin Smith.

Just three months after PepsiCo's blockbuster purchase of Siete Foods for $1.2 billion, another big deal shakes up the natural and organic products industry, with Wednesday's announcement that Flower Foods Inc. agreed to acquire Simple Mills for $795 million.

The deal, in which Simple Mills becomes an independent subsidiary of Flower Foods, adds a generous better-for-you food portfolio to Flower Foods’ existing product line, nearly all of which is bread brands, from Dave’s Killer Bread to Wonder. Simple Mills' products include cookies, bars, crackers, baking and pancake mixes and more.

“While we’ve experienced significant growth in recent years, we’re confident now is the time to take this next step to capitalize on the many opportunities ahead and seize our full potential,” said a Simple Mills spokesperson. “With Flowers’ partnership, Simple Mills will be well positioned to broaden distribution, accelerate innovation and amplify brand awareness.”

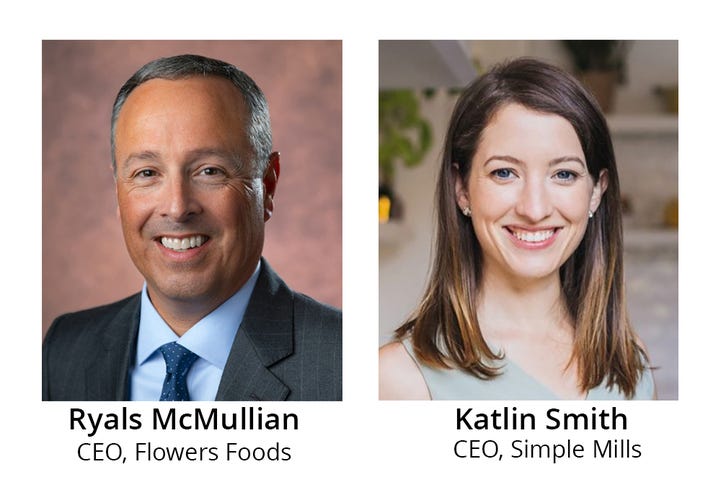

Flowers Foods chairman and CEO Ryals McMullian said in a statement, “We look forward to collaborating with (Simple Mills team) to generate continued growth while preserving the brand’s integrity and staying true to its unmatched quality and taste.”

Coming on the heels of the Siete Foods deal, the Simple Mills acquisition might signal a pivot in the investment landscape for the natural and organic products industry. The industry took off during COVID and its immediate aftermath. But investors began turning away in 2022, for a variety of reasons, including interest rates that made borrowing money much more expensive.

“When we see these deals, they return money to investors, who are getting back more than they ever thought they would, because it took longer for the deals to close” thanks to COVID and the overall disruption that hit the industry in recent years, said Nick McCoy, co-founder and managing director of Whipstitch Capital. “So now, new money from investors will become available, including for smaller companies.”

Amassing capital has stood as a principal pain point within the industry since 2022, especially among start-ups, McCoy said. But now that people who invested in companies like Siete and Simple Mills are receiving investment windfalls—McCoy said that the payouts for these deals could yield returns of as high as 60-times capital outlay—the funding cycle will begin working again for smaller companies.

“The capital cycle has been slow, but we are seeing it speed up,” he said. “It will be the biggest engine of change this year.”

McCoy said the industry supports more than 70 companies today with annual revenues in excess of $100 million. All of them could be targets for deals—and subsequent financial boons for investors in the natural and organic products industry.

More than 30,000 natural and conventional retailers across the country sell Simple Mills products today. According to a news release about the acquisition, Simple Mills generated $240 million in net revenue in 2024, representing 14% growth compared to the prior year.

The partnership could stoke Simple Mills’ innovation efforts and lead to more product launches, said the company spokesperson.

In addition, the partnership could lead toward enhanced efficiencies and fresh opportunities.

“Flowers has deep expertise in scaling brands, which we expect to enable us to accelerate growth in both current and new channels,” said the spokesperson.

In a statement, Simple Mills founder and CEO Katlin Smith said the transaction “marks the beginning of a new phase of growth for Simple Mills.”

Simple Mills beneficiaries of the $795 million cash deal include Smith, Simple Mills management, Vestar Capital Partners (the largest individual stakeholder) and initial angel investors.

About the Author

You May Also Like