.png?width=700&auto=webp&quality=80&disable=upscale)

Market Overview 2020: Reasons organic attracts consumers evolve from simply ‘for the kids’Market Overview 2020: Reasons organic attracts consumers evolve from simply ‘for the kids’

While consumers expect organic to follow overall food trends, more than ever before, they also are looking to organic as a solution to climate change and social issues.

July 8, 2020

Once again, the organic industry continued to grow in 2019. While not wanting pesticides in products and food is still a key growth driver, as the organic marketplace becomes more mainstream, consumers are turning to it for myriad reasons from clean products and sustainability to transparency in supply chain, human and animal welfare. Of course, the COVID-19 pandemic has also brought new and different growth to the category.

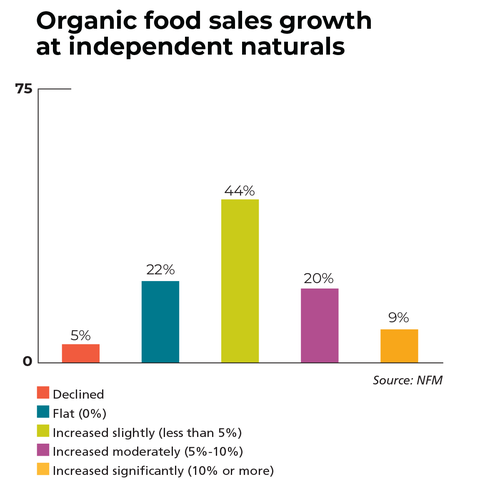

Over the past decade, the organic marketplace has more than doubled in size, growing from $24.9 billion in sales in 2010 to $55.1 billion across all retail channels in 2019, according to the Organic Trade Association’s (OTA) recently released annual Organic Industry Survey. In 2019, organic food sales reached $50.1 billion while nonfood sales, including dietary supplements, personal care, textiles, household cleaning products, pet food and flowers, hit $5 billion in sales. Together, the organic products industry grew at a rate of 5%. Organic food sales grew at a rate of 4.6% and organic non-food product sales grew at 9.2% across all channels, well above total sales growth of similar products (organic and conventional) which was 2.6%, according to the Natural Foods Merchandiser Annual Market Overview Survey.

Beyond millennials and young families looking for clean food, the appeal of organic now extends beyond food issues for millennials and Gen Z shoppers, who were born after 1996. They also seek out organic for its human and animal welfare practices and because its sustainable and transparent supply chains outshine their conventional counterparts. As a result of these holistic, better-for-the-world demands, brands pair the USDA Organic certification with others such as non-GMO, fair trade or B Corp, even as organic itself addresses the welfare of people, animals and the planet. And thus, consumer conversation has grown to include “organic regenerative agriculture,” which now has its own certification through the Rodale Institute.

Some industry members worry that the rising organic regenerative agriculture movement will cause consumers confusion rather than clarity (remember the confusion as non-GMO took center stage?) while splintering the industry. Yet leaders at brands such as Dr. Bronner’s, Patagonia Provisions and Alter Eco say regenerative agriculture, with organic certification as a baseline, is necessary to preserve organic’s intention to provide clean food while also being better stewards of the land. It’s a distinction they say is necessary as the organic industry becomes more mainstream with larger companies and big ag involvement. Consumers are starting to catch on.

“We’ve seen a big uptick in questions and excitement around regenerative agriculture,” says Lee Robinson, Whole Foods Market’s director of dairy and beverage. “It’s one of the trends we’ve noted in 2020; people want to know more about where their food comes from, they see regenerative agriculture as organic-plus. Most consumers don’t understand the intricacies of the National Organic Program (NOP) and the regulations. They see organic as a cleaner product and see regenerative as building soil health, thinking more about climate change and the potential of organic farming to reduce carbon. For different people, regenerative means different things, and that is what we will see play out. We don’t want to discount the great work organic farmers are doing, but the barrier to entry of organic is the three-year transition time.”

Organic category growth

Back in 2019, the gateway to organic continued to be fruit and vegetable sales, which were up nearly 5% and reached $18.2 billion in sales for the year across all retail channels according to the OTA Organic Industry Survey. Organic fruit and vegetables, which includes produce as well as dried fruits, vegetables and beans, now holds a 15% penetration into the overall fruits and vegetables market. Organic produce alone now makes up almost a third of all organic food sales.

Read all of the Natural Foods Merchandiser Market Overview coverage:

On the other hand, organic milk, though still a household staple, maintained relatively stable sales in 2019 as the industry dealt with oversupply issues and the continued large pricing gap between conventional and organic. Still, the $6.6 billion organic dairy category grew at a rate of almost 2%, once again faster than the overall dairy market, which only grew at a rate of 0.2%.

While staples drive organic, two natural products industry trends changed organic, too: low-to-no-sugar products and those serving special diets, including keto, Paleo and others.

The growing interest in lower-sugar products has significantly reduced sales in the organic beverage aisle as juice sales of any kind have fallen off only to be replaced by an increasing number of water-based beverages that are natural but not necessarily certified organic. The reduced-sugar influence was also seen in condiments with the revamping of organic salad dressings, sauces and condiments such as sugar-free ketchup. In fact, organic ketchup sales hit $57 million in 2019, up almost 16% from the previous year. These clean and low-sugar products also played into an increase in organic keto and Paleo diet offerings. Although consumers might want reduced-sugar spaghetti sauce and beverages, their desire for organic chocolate, desserts and baked goods remains strong.

Yet as consumer interest in “clean” food helps to grow organic, some categories still have limited—even no—organic offerings. Just look at plant-based products, especially meat analogs, which rarely embrace organic. Likewise, organic collagen isn’t available and organic hemp is still in limited supply. Organic certification is expected to be a key differentiator for hemp products in the future, as supply and certification processes catch up with demand.

Organic nonfood sales

The organic nonfood market, which accounts for 9% of overall organic sales, also saw growth in 2019. While organic pet food remains one of the smaller organic sectors, consumers are starting to seek out organic pet food for their furry family members for the same reasons they choose their own food: clean ingredients and a transparent supply chain. In the past, supply chain hiccups, such as a limited organic poultry supply, have limited growth in this category. Organic pet food has been able to overcome supply challenges as organic meat and poultry becomes more readily available.

Organic personal care still tends to be limited to products containing a single or few ingredients. A lack of available active ingredients and preservatives makes it challenging for organic personal care to compete against high-end nonorganic products. And the lack of organic personal care regulation makes it difficult for certified organic products to stand out. Similarly, organic household products are also limited by ingredients and compared performance wise against the chemical-laden mainstream products.

In times like these: COVID-19

While demand for ready-made and prepared foods translated to strong organic sales in 2019, with the onset of COVID-19, foodservice and deli both took a hit as consumers started shopping online, and natural products retailers and grocery stores closed salad bars and deli areas. Yet with consumers still wary of restaurants, there is an opportunity for retailers to rethink deli and how they offer prepared foods in-store and online.

Pandemic purchasing changes are expected to translate into growth for organic staples, some of which experienced slow growth in 2019. These items include eggs, flour, rice and pasta. Noting that the recently released OTA Industry survey gathered information before COVID-19, CEO and Executive Director of the Organic Trade Association, Laura Batcha says, “Our 2020 survey looks at organic sales in 2019 before the coronavirus outbreak, and it shows that consumers were increasingly seeking out the USDA Organic label to feed their families the healthiest food possible. The pandemic has only increased our desire for clean, healthy food.” She adds, “The commitment to the organic label has always resided at the intersection of health and safety, and we expect that commitment to strengthen as we all get through these unsettled times.”

Even as organic becomes more readily available, in some categories, price can still be a barrier to entry for organic. For this reason, combined with possible economic pressures post-pandemic, stores likely will continue to invest heavily in private label and broaden their depth of offerings.

Private label organic is perceived by customers to be reliable and trustworthy while also being affordable.

That’s a win in these times.

About the Author

You May Also Like