The co-op difference: Emerging brands can succeed with purchasing cooperativesThe co-op difference: Emerging brands can succeed with purchasing cooperatives

Purchasing cooperatives such as National Co+Op Grocers can help emerging brands launch and grow, even if they aren’t ready for national distribution. Find out how.

January 22, 2025

At a Glance

- NCG offers access to a supportive, community-focused retail network that values local, organic, and fair-trade products.

- Co-ops that belong to NCG lead the country in sales of local, organic and fair-trade products.

- To reach co-op shelves, founders need to have realistic plans and growth strategies—and communicate them clearly.

Purchasing cooperatives aren’t like a typical grocery store.

Unlike investor-owned corporations that operate grocery chains, purchasing cooperatives are independently owned and operated by members. They source more from local farms and producers. National Co+op Grocers (NCG), the largest trade association of retail food cooperatives in the United States, said the average co-op within its network sources from 169 local farms and producers.

For many local brands, it’s a way to launch a product.

“I’m a monstrous fan of this organization,” said Gary Hirshberg, CEO of Hirshberg Entrepreneurship Institute and co-founder of Stonyfield Farm, during a panel discussion, “The Basics of Working With a Purchasing Cooperative,” focused on NCG and available to watch on-demand. “My roots go all the way back. This is how Stonyfield started 40 years ago. We began in our local co-op.”

Still, demystifying the process of how to get shelf space can feel complicated. Many companies have no idea how to break in.

“We like to work with brands at all stages,” said Jason Stein, category management director at National Co+Op Grocers, which is headquartered in Saint Paul, Minnesota. “Because we're a quirky organization, people often—even our most established brand partners—don't understand who we are.”

What brands should know about NCG

With 240 storefronts in 39 states, NCG’s network of 165 members range from single-store operators to its biggest member, PCC Community Markets in the Seattle, Washington, area. Its newest members include Buffalo Mountain Market in Hardwick, Vermont, and SunCoast Market Co-op in Imperial Beach, California.

“We are a cooperative owned by the co-ops in our system,” Stein said. “We exist to provide value and services at their direction for them.”

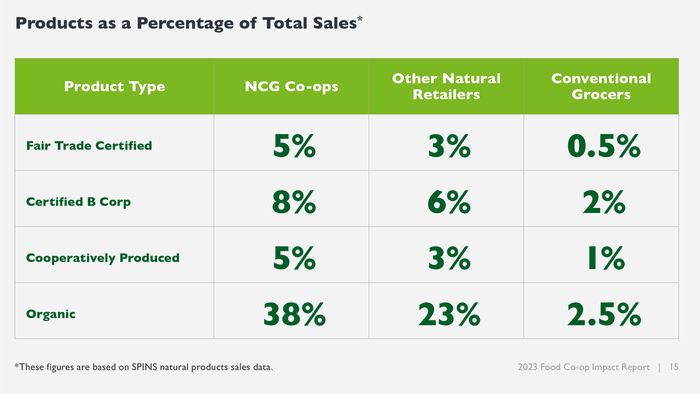

In 2023, NCG led all natural food retailers nationwide in percentage of sales derived from local, organic and fair-trade foods and products. Based on SPINS natural products sales data, NCG co-ops sold more fair-trade certified, B Corp certified, cooperatively produced and organic products than other natural retailers and conventional grocers.

About 5% of sales at co-ops come from fair-trade products and 8% of sales from certified B Corp brands, Stein said. Approximately 38% of NCG's food co-ops' combined annual $2.5 billion sales come from USDA Organic products, leading the industry. Other natural grocery retailers report organic products account for 23% of sales, while conventional grocers report just 2.5%, according to SPINS’ 2023 data.

Co-ops aren’t homogenous

Like choosing to be a member of a local credit union or REI, members can choose to join a co-op and then decide if they want to join a secondary, national cooperative like National Co+Op Grocers.

“Each co-op is unique to its community,” Stein said. “NCG, as a secondary co-op, exists to take all the collective buying power of all the co-ops in the system and secure more favorable contract terms.”

Within NCG’s network, there’s a mix of natural and organic-focused co-ops. Some co-ops largely have a conventional assortment. Others are vegetarian, so those co-ops won’t carry any products that contain meat or seafood, Stein said.

NCG uses its collective buying power to secure better promotional plans and vendor investments to drive sales of their brand products at member co-ops. “We leverage that collective volume, while still allowing each of the co-ops to maintain their autonomy and be able to meet the demands of their specific communities,” Stein said.

NCG co-ops value accessibility, inclusion

Stein said NCG’s co-ops are leaning into who is welcome at a co-op, to ensure the assortment and products being offered are welcoming to all community members.

“Plenty of people are intimidated by natural foods,” Stein said. “They don't know anything about it. It seems expensive, is it going to taste good?”

As a result, many co-ops within NCG have taken it upon themselves to bring in some familiar conventional products to help shoppers find products they are comfortable with while they explore. “It is a constantly evolving sort of thing,” Stein said.

Strong engagement, local products

Most co-ops within NCG’s network are consumer cooperatives, so they are owned by the people who shop at the stores. Strong local engagement translates into dollars at the cash register. The average co-op within NCG generates $5.6 million in register sales of local products each year, Stein said.

“Amazingly, co-op members account for 65% of sales at the typical co-op,” Stein said. “Which is a pretty profound number and reflects how invested community members are in these co-ops and how engaged these shoppers are.”

Those sales also benefit the co-ops’ communities. In 2022, the average co-op donated $149,000 to local community groups through register round-up initiatives—cashiers asking customers to round up their grocery bills to the next dollar amount.

Expect to pay fees

Just like other retailers, NCG has fees. “It always comes up,” Stein said. “Every retailer has fees or gets at fees in different ways.” While some retailers may not have fees, they might require more investments in promotions or Everyday Low Price promotions that have less pass-through to pad their margins, Stein said.

“Our fees truly go to cover the costs of running NCG,” Stein said. That includes paying wages and benefits for staff, keeping the lights on for operating costs, producing programs and the outputs of the programs, including the flyers members get. “Our fees do not go to enrich investors because we’re owned by the community of co-ops that are owned by community members,” Stein said. “They do not go to give a big bonus to our CEO, they truly go to covering the cost.”

Go online to get started

Brands looking to break into NCG should start by attending a “Get to Know NCG” webinar on its Partner Co+nnection website.

“The brutal reality is that we say no to far more brands than we say yes, by virtue of the sheer number of product submissions we receive daily,” said Jess Saunders, associate category manager at National Co+op Grocers.

Getting on shelf and staying there

Communication is key. If you're experiencing challenges with your co-packer or distributor, share details, Saunders said, so the retail buyer knows what is happening instead of simply being out-of-stock.

“Getting a brand off the ground is incredibly difficult,” Saunders said. “Retail buyers, at least at co-ops and NCG, are much more forgiving when we understand what's going on. We can even help, at times, navigating some of those challenges.”

Share plans for growth

“We don't frown on brands telling us about growth in other channels and retailers,” Saunders said. “There are synergies with some retailers that we all benefit from. Knowing a brand's growth plan can help us tap into those synergies.”

Don’t expect discounts on cost or frequency of promotions to fund going into Walmart, Saunders said. Brands that have a “strong, open and honest relationship, a true partnership” with NCG can have better success with its member co-ops and shoppers.

Set realistic expectations

Have a realistic, achievable growth plan, Saunders said. Know what is truly possible to ramp-up co-packers and distributors.

“While gaining new distribution is important for growth, new placement is way less efficient than established placement,” Saunders said. “Success is not getting on shelf. It’s staying on the shelf.” Winning happens with repeat purchases, gaining category share and increasing velocities, she said, which is only achieved through nurturing and fueling each retail placement.

Shifting categories

Consider inflation and what's needed to be successful. Consumers continue to seek out private label brands and switch retailers to get the best deals. Some are simply buying less.

“Put thought into how you'll compete in categories with these shifting dynamics,” Saunders said. “Have a reason for being, versus simply being a copycat of another brand.” Understand your role and unique characteristics within the category. Know the difference between replacing an existing consumer solution and expanding the consumer solution or contributing something to the category.

“Never make a sales pitch based on slandering a competitor’s product,” Saunders cautions. “This is an absolute turnoff.” Instead, highlight what sets your product apart from the competition. “And let the buyers make the call,” Saunders said. “Buyers doing their homework. So don’t make a claim or provide an insight you’re not prepared to speak to when a buyer asks for more information.”

Biggest takeaway

“We at NCG aren’t looking for exclusivity, but we are looking to be treated equally,” Saunders said. “And have a relationship that is beyond transactional, that results in growth in sales for the brand, NCG and our member co-ops.”

About the Author

You May Also Like