Skyrocketing delivery growth drives 28% increase in October's online grocery salesSkyrocketing delivery growth drives 28% increase in October's online grocery sales

Online grocery sales hit $10.5B in October due to delivery growth, loyalty discounts and promotions. Shoppers also ordered more food, more frequently. Take a look at the details.

November 21, 2024

At a Glance

- As national retailers and delivery services offered deeply discounted loyalty memberships, online orders grew.

- Households with adults ages 30-60 led the 46% increase in delivery sales, which totaled $4.8 billion in October.

- Buy-online, pickup-in-store sales rose 20% in October: Order volume was up 6%, while order value grew 13%.

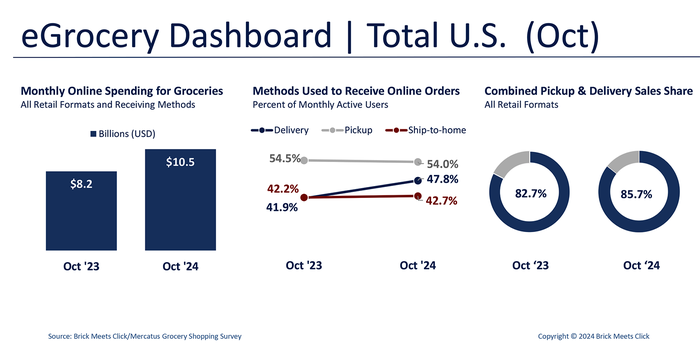

Online grocery sales spiked by 28% year over year to $10.5 billion in October, with all three receiving methods posting sales growth, according to the Brick Meets Click/Mercatus Grocery Shopper Survey released this month.

It was a record high for online grocery sales and was the second month in a row that online sales growth exceeded 20%, the report noted.

Delivery channels saw the biggest growth, skyrocketing 46% to $4.8 billion, which was a new record for the segment, and its monthly active user base grew 16% year over year. Most of those gains were due to increases in users from households between the ages of 30 and 60, according to the report.

Month-over-month, order volume for delivery jumped 24%. “In addition, delivery’s average order value (AOV) climbed by over 15%, partly due to a growing share of customers who use the services more frequently and tend to spend more as their usage increases,” the survey noted. Grocery pickup also experienced substantial growth year over year, capturing $4.2 billion in sales, for a 20% increase. Pickup orders climbed 6%, largely driven by a 13% increase in average order volume.

Ship-to-home also got a 6% boost year over year in October on sales of $1.5 billion. The monthly average user base climbed 3%, due in part to strong growth in demand for users between the ages of 18 and 29 and those over the age of 60. The average order value for ship-to-home was up nearly 12%, the result of Amazon’s pure-play segments, which saw an increase of nearly 16% year over year.

Across all three methods, the monthly average user base grew 1.6% with more than half (54%) of U.S. households making one online grocery order for the month. The total percentage of online shoppers inched up 0.6% for the month, showing that much of the sales growth was due to light or lapsed users coming back to online purchases.

But the positive results were largely driven by grocers offering deep discounts on loyalty programs. Kroger recently offered a 20% discount on its membership program, as did Walmart at 50% and Instacart at 80%, the report noted.

“Delivery is riding its next growth curve, fueled not simply by subscriptions or membership offers, but by promotional pitches that incent the customer to commit for a year,” Brick Meets Click partner David Bishop said in a press release. “While firms occasionally revert to their standard ‘free trial’ offers, the surge of new discount tactics seem to have a broader appeal that extends beyond the existing customers of the retailer or provider offering it.”

Retailers and third-party providers also offered special promotions waiving delivery fees on larger orders. Similarly, DoorDash and Uber offered 30-day free membership trials, and Amazon tripled its 30-day free trial for Amazon Prime to 90 days for its recent Prime Day sale.

This could be good news even for retailers without a competitive online purchase option “due to the increase in cross-shopping behaviors,” the report noted. Households that ordered groceries online from both traditional grocers and mass merchants in October grew five percentage points to 40% compared to the same period in 2023.

"As national giants like Walmart accelerate growth with aggressive membership offers, there are effective ways for regional grocers to adapt and better connect with their core customers," Mercatus Chief Growth Officer Mark Fairhurst said. "By improving loyalty programs and enhancing the relevance of digital initiatives to leverage targeted and personalized campaigns that integrate online and offline promotions, regional grocers can seize new opportunities to strengthen their position in a competitive market."

This article originally appeared on Supermarket News, a New Hope Network sister website. Visit the site for more trends and insights into the natural and organic products industry.

About the Author

You May Also Like

.png?width=700&auto=webp&quality=80&disable=upscale)