Key data to drive natural retailers’ strategies, plans and decisionsKey data to drive natural retailers’ strategies, plans and decisions

NielsenIQ offers data and insights to help natural and organic retailers prepare for changing demographics, shopping styles and more. See some highlights.

Retail landscapes rarely get stuck in ruts for long. Economics, culture, technology, social forces and other factors constantly push and prod retailers, forcing them to evolve along with shifting societies and norms.

Enclosed shopping malls, for example, dominated big swaths of culture for decades. Today, they’re vanishing. Big Box stores punished the bottom lines of Main Street shops for years—but now those behemoths are shuttering, leaving big vacancies at suburban shopping plazas across the country.

Amazon. TikTok Shop. DTC. Gen Z. All of it and much more today contribute toward a retail environment experiencing rapid change.

Both Natural Products Expo West and the upcoming Newtopia Now in Denver this August serve as showcases for all that is fresh and novel in the natural and organic products industry, from brands to services to new retail strategies.

At Expo West in Anaheim in March, NielsenIQ leaders converged on stage to explore today’s dynamic retail ecosystem in a session called, simply, The Future of Retail. The enlightening session, based on data from NielsenIQ, yielded a proliferation of powerful insights for all retailers and brands competing in what has become an especially effervescent landscape. Read on for key takeaways.

Turn off the channels, focus on attributes

Consumers increasingly ignore specific channels—such as brick-and-mortar retailers, or online marketplaces. Instead, what they care about is product attributes, such as desired ingredients like ashwagandha or dietary qualities like gluten-free. In fact, the power of brands is dimming, too. Nearly 80% of all Amazon searches are unbranded. Instead of thinking about channels, focus on consumers.

Promotions matter

Promotions led to 26% of dollar sales, and 71.5% of growth.

Social shopping emerges as threat to traditional retailers

The rapid rise of channels like TikTok Shop further disperses the purchasing attention of consumers. NielsenIQ data reveals that 55% of shoppers report that they shop directly through social media or live stream platforms. Just months after it’s United States debut in September of 2023, TikTok Shop became the 14th largest health and beauty retailer in the country, and the 30th largest for food. About 80% of TikTok dollars, in fact, come from health and beauty.

Celebs turning audiences into consumers

The brand Once Upon a Farm experienced growth of 50% in 2022—thanks in part to actress Jennifer Garner’s association. How did the beverage brand Prime see 700% growth in 2022? Founders Logan Paul and KSI—huge personalities via YouTube channels and among gamers—launched the brand and serve as its ambassadors.

Algorithms rising

At the online grocer Hungry Root, most customers trust the company to curate weekly groceries. In fact, algorithms are responsible for 72% of all items purchased. According to NielsenIQ, the emergence of algorithmic purchasing is “immanent” and “requires a new strategic approach” toward selling products.

Gamifying and personalizing nutrition

At retailer Earth Fare, a partnership with Merryfield allows stores to “gamify” nutrition labels. Earth Fare also works with GenoPalate to link nutrition to individual consumers’ genetic makeup.

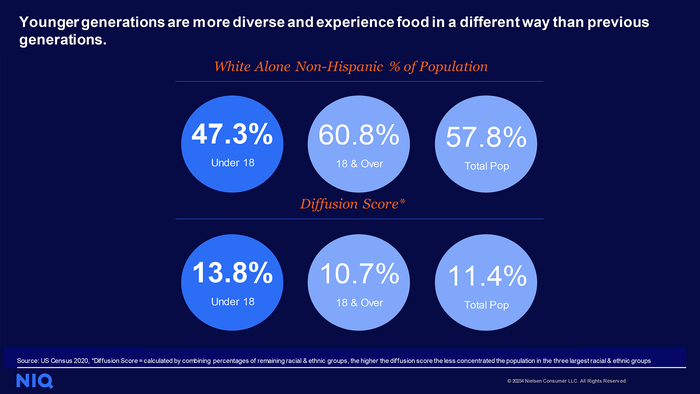

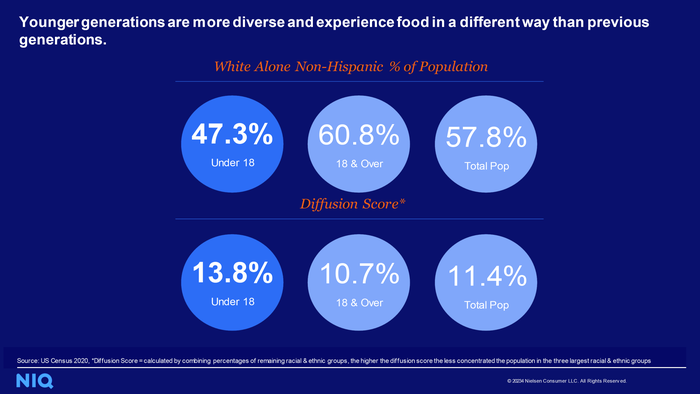

Generational shifts

By 2030, most Gen Xers will be over 55. Between Xers, baby boomers and the Greatest Generation, that translates into 114 million consumers with spending power. But by the same year, 67% of the population will be millennials or younger, up from 59% in 2022. And millennials rank highest for online shopping.

“Better For” products driving growth

Better For products, as defined by NielsenIQ, in 2024 witnessing four-year CAGR growth of 9%, compared to 6.2% for conventional. In addition, 62% of Better For™ growth driven by small brands.

Omni purchasing witnessing biggest “Better For” market share

For beverages, 16% of omni-channel sales in 2023 were "Better For," compared to 8% for traditional. For omni-channel salty snacks, Better For accounted for 14% of sales, compared to 8% for traditional.

Some “Better For” categories seeing big growth

Better For formula and children’s nutritional beverages up 56%; bagels boosted 40%; beverages experiencing 28% growth.

Healthy runway for “Better For” brands

Among all generations, Gen Z has embraced "Better For" brands with the most oomph. Gen Z households are increasing their spend on products by 7%, compared to 1% for the total panel.

Broadcast those attributes

NielsenIQ sees biggest growth in products with on-package claims about environmental, sustainable packaging, animal welfare and social responsibility. Products with more types of claims grew two-times faster than those with just one type of claim. Also, products with higher degree of sustainability related claims experience upped loyalty. For example, brands with more than 50% of sales from products with sustainability claims witness repeat rates of up to 34%.

Lean into innovation and run with it

Manufacturers investing in and growing innovation sales in 2022 were 1.8X more likely to grow overall sales than those with flat or declining innovation sales. New and improved products can attract new buyers, create new usage occasions, justify price premiums and keep brand relevant.

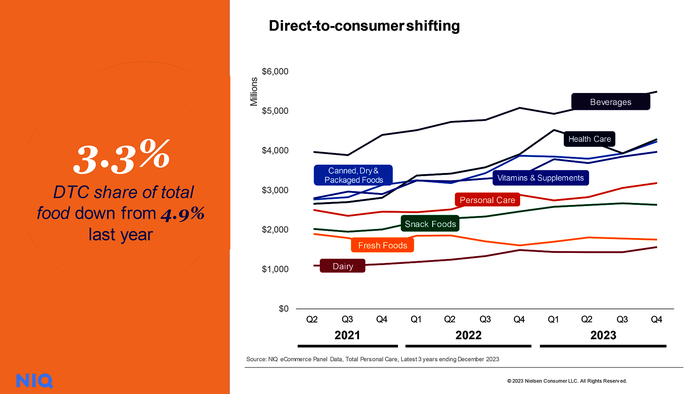

DTC to brick-and-mortar a smart path

The path from DTC to physical stores drives activation success. But doing so demands thoughtful activation. Key steps include leveraging consumer feedback to optimize packaging and marketing messaging before pivoting to brick-and-mortar; exercising patience with timing and partnerships to avoid impacting DTC business; investing in endcap design to grab consumer attention; and ensuring packaging stands out and makes brand’s unique advantages clear to consumers.

Watch the Future of Retail session from Natural Products Expo West on demand.

About the Author

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.png?width=700&auto=webp&quality=80&disable=upscale)