Botanicals describes the broad category of plant-based products, including medicinal mushrooms, that can address different health needs. Herbs are a subset of botanicals. The key distinction? Herbs are also used frequently for culinary pursuits, due to their fragrances and flavors.

So, for example, basil is both a botanical and an herb. But ginkgo biloba, a tree native to China that’s used in mental wellness formulations, does not get incorporated into foods as a flavor enhancer, so the botanical is not considered an herb.

In recent years, herbs and botanicals have been the veritable celebrities of the supplement (and food and beverage) aisles. Turmeric’s profile rose across the 2010s, for example, seeing 17.1% growth in 2018, according to NBJ data. Its popularity grew so widespread that it branched out of the supplements section and got added to everything from ready-to-drink teas to skin-exfoliating products to dog treats. For 2024, NBJ forecasts 2.3% growth for turmeric supplements.

Ashwagandha has experienced a similarly frothy ride. 2020 sales of this evergreen shrub inflated by 50.4%, then dropped to an estimated 13.9% growth for 2023. NBJ predicts 9.7% growth for 2024—which is still extremely strong. Ashwagandha is considered an adaptogen, and the active ingredient within turmeric, curcumin, is believed to support adaptogenic effects. Adaptogens, which are compounds found in some plants and mushrooms that help the body wrestle with fatigue, stress and anxiety, have emerged as a key subcategory within herbs and botanicals.

Major herbs and botanicals

While the tally of vitamins and minerals is relatively small, herbs and botanicals number in the hundreds. Many represent mere blips in sales—like evening primrose, with projected sales of $23 million in 2024, according to NBJ—while others claim much larger market share. For example, sales of hemp CBD (aka cannabidiol, a compound in hemp that consumers embrace for everything from sleep to anxiety relief) are forecasted to command $315 million in 2024.

That number is strong, but not enough to stop the rise of turmeric, which held the No. 2 slot for sales in 2022. For 2023, NBJ projected that turmeric would become the top-selling herb and botanical, with $357 million in sales.

Looking further ahead, NBJ predicts that hemp CBD sales will shrink further to $315 million in 2024, while turmeric will hit $366 million. Three other herbs and botanicals, according to their estimated 2023 sales, are expected to do well this year:

Ashwagandha, an adaptogen that offers many benefits, including sleep, stress reduction, blood sugar support and focus (predicted at $375 million for 2024)

Noni juice, a vitamin C–rich juice from a tropical fruit that people take for joint relief, immune support and more (predicted at $288 million for 2024)

Echinacea, a flower commonly used to help with colds and immunity (predicted at $226 million for 2024).

LifeSeasons Theraputics Anxie-T

This powerhouse supplement supports mood and mental health with key ingredients for calm and serenity, including magnesium, L-theanine, Andean cocoa seed extract, GABA, kava kava, theobromine and Sensoril, a branded ashwagandha extract. SRP: $42.99

Malama Mushrooms Lion’s Mane Dual-Extract Tincture

Malama Mushrooms uses only Lion’s Mane mushroom grown in Hawaii for this tincture, which can support improved cognitive function and help reduce inflammation. SRP: $30 for a 1 fluid ounce bottle

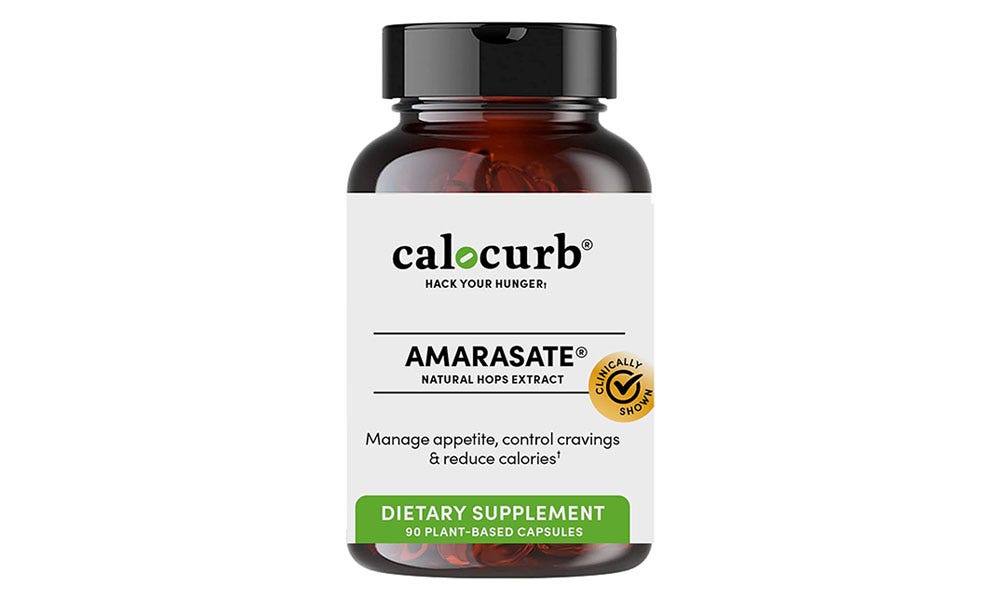

Calocurb Amarasate Natural Hops Extract

Two vegetarian capsules of Amarasate, a brand of New Zealand hops flower extract, provides 250 mg this botanical ingredient. It does not contain sugar, starch, yeast, wheat, gluten, soy, milk, eggs, shellfish, fish, peanuts, tree nuts or artificial colors, flavors or preservatives. Certified Vegan Friendly. SRP: $69.99 for 90 capsules

About the Author

You May Also Like

.png?width=700&auto=webp&quality=80&disable=upscale)