FMI’s top strategies to spark retail food service growthFMI’s top strategies to spark retail food service growth

Through retail food service, consumers seek budget-friendly and nutritious prepared foods for convenient family meals. Consider this new data when choosing your store’s offerings.

December 13, 2024

At a Glance

- For convenient, quick meals, shoppers mix ready-to-eat, nutritious dishes from retail food service with scratch cooking.

- To meet demand, retailers are offering more nutritious, organic and non-GMO meal options through food service operations.

- To meet demand, retailers are offering more nutritious, organic and non-GMO meal options through food service operations.

From rotisserie chickens to chimichangas, from packaged salads to pizza by the slice, retail food service offerings continue to drive strong sales while satisfying shoppers’ growing appetite for affordable, no-fuss, delicious, prepared foods. That’s the overarching takeaway from FMI, the Food Industry Association’s new report, The Power of Foodservice at Retail 2024.

Presenting NielsenIQ sales data, along with findings from FMI’s August survey of 1,535 U.S. shoppers who purchase from retail food service at least occasionally, the report reveals the latest consumer patterns, priorities and demands around this dynamic sector. It also identifies the best opportunities for retailers to elevate their food service game to deliver on today’s shoppers’ needs.

A quick aside before delving into the data: FMI uses the terms retail food service, deli-prepared foods and grocery deli–prepared foods interchangeably. They all describe fully or partially prepared items, whether complete meals or parts of meals, that offer convenient, fast alternatives to at-home cooking or restaurants. Examples include chicken wings, sushi, deli sandwiches, salad bars, hot food bars and much more.

Here are the most salient takeaways for independent natural products retailers to know.

Rick Stein, vice president of fresh foods at FMI

Food service sales stay strong

“The retail food service segment has shown consistent growth over the past year, highlighting its role as a convenient and budget-friendly option,” Rick Stein, vice president of fresh foods at FMI, said in a November briefing about the report. “This growth speaks to the rising consumer demand for fresh, ready-to-eat options that save time and effort.”

According to NIQ data, the total food service sector grew 1.4% in dollar sales and 1.2% in unit sales over the 52 weeks ending Aug. 10, bringing its market value to $50.9 billion. While that increase may seem modest, Stein called it “stabilized growth” following “several years of strong momentum” as grocers’ food service departments rebounded after the COVID-19 pandemic.

In other good news, household penetration remains high, per NIQ, with more than 70% of U.S. households purchasing deli-prepared items at least once over the last year. On average, shoppers frequent food service 9.5 times per year and spend $8.30 per visit.

Category movers and slugs

“Within this segment, certain categories are driving momentum, such as pizza and fully cooked meats, both of which have shown robust year-over-year growth,” Stein said.

Indeed, NIQ data show grocery stores’ pizza sales surging 7.8% since August 2023 to break $1 billion in sales, while fully cooked meat sales expanded 6.2%. Complete meals and handheld entrées also had great years, posting 8.3% and 6.1% growth, respectively. Cheese, dips and spreads performed well too.

A few categories dipped slightly in both unit and dollar sales over this 52-week period, specifically salads and sushi. Lunch meat took a larger hit, per NIQ, as a result of food safety recalls.

Familiarity still rules, but palates diversifying

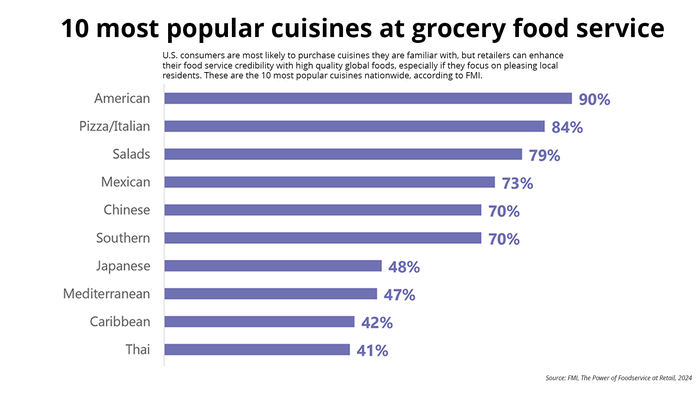

By and large, shoppers still favor foods that are familiar to them over more diverse options. When FMI asked survey participants which types of cuisine they’re most likely to purchase from grocers, 90% chose American, giving it the most mentions of any cuisine. Next came pizza/Italian (84%) salads (79%), Mexican (73%), Chinese (70%) and Southern (70%), all of which are well entrenched in the standard U.S. diet.

After that, there was a steep drop-off. Japanese cuisine landed next on the list, selected by 48% of shoppers, followed by Mediterranean with 47%.

However, consumer interest in a broader array of cultures and cuisines is increasing rapidly, FMI reports, especially among Gen Z and millennial shoppers. Younger consumers not only represent more diverse communities but also, regardless of their own backgrounds, generally show more interest in enjoying foods and flavors from around the globe.

Hybrid work, health, convenience compel sales

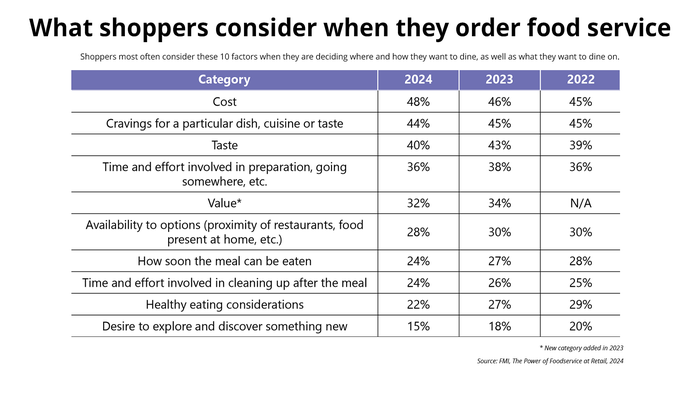

“Consumer behavior is a significant driver behind the growth of retail prepared foods,” Stein said. Citing FMI’s research, he detailed three specific behavioral patterns shaping shoppers’ purchasing habits in this realm.

First, the widespread shift to hybrid work—a mix of onsite and remote work—has had a direct impact on meal choices, Stein noted, with more consumers turning to retail food service for lunch and dinner. “Lunch in particular is seeing the largest net increase, as shoppers seek convenient solutions when working both remotely and onsite,” he said.

Second, consumers are placing more emphasis on health and nutrition. About two-thirds (63%) put at least some effort into making nutritious prepared food choices, FMI’s survey shows, while 19% put in a lot of effort. However, only 26% of respondents say they are very satisfied with the nutritious selections available from their grocers today. “This gap represents an opportunity for retailers to meet a clear demand for more nutritious options,” Stein said.

Finally, convenience continues to be a critical factor, especially for time-strapped shoppers, Stein concluded. This explains why, across all mealtimes, the most common food-preparation method is a hybrid one. Per the survey, 54% of respondents most often combine some cooked-from-scratch items with semi- or fully prepared products (bagged salad, rotisserie chicken, etc.) to create a complete meal. “This approach is popular with shoppers who want to save time but still want to control the quality and variety of their meals,” Stein noted.

5 key opportunities for retailers

The same trends that are propelling growth in retail food service also reveal exciting opportunities for retailers to meet evolving consumer needs more effectively, Stein said. Referencing FMI’s report, he highlighted five key areas where stores can enhance their offerings to better support today’s shoppers.

Step up meal-planning support. “Retailers can assist by offering affordable, convenient meal ideas that encourage a mix-and-match approach,” Stein said. “This could involve promoting deli-prepared foods as an easy way to complement scratch cooking, giving shoppers flexibility in their meal.”

Innovate around breakfast. Dinner remains the most popular meal for food service, with 37% of respondents buying prepared foods for supper at least once a week. Lunch is a close second, with 35% purchasing deli-prepared items for their midday meal at least weekly. Breakfast finishes a distant third, purchased weekly by 22% of shoppers.

Translation? “There is untapped potential in breakfast,” Stein said. “Innovation in breakfast could be a game changer.” By introducing grab-and-go breakfast items or easy-reheat meals, “retailers can build excitement and attract consumers looking for convenient breakfast solutions,” he added.

Trumpet value. “The food-service value equation is crucial to shoppers,” Stein said. “Notions of value have expanded to become more nuanced, to include dimensions such as quality, relevance, experience and convenience.”

All factors considered, FMI’s survey reveals that over half of shoppers see deli-prepared food as a good value compared to quick-service or fast-casual dining. “Retailers have an opportunity to emphasize this value in their communications, helping shoppers understand that grocery prepared foods are an affordable alternative to dining out,” Stein explained.

Take a page from restaurants’ playbook. Many consumers now expect retailers to offer the same conveniences that they’ve become accustomed to from restaurants, Stein said.

For example, when FMI asked which amenities would compel shoppers to purchase more retail food service, 66% said having the menu available online, something that nearly all restaurants do these days.

The next biggest motivator, indicated by 60% of shoppers, is having the ability order in advance via an app or website, followed by an inside pickup station for preordered food (55%), a drive-through option (54%) and a separate checkout in the deli-prepared area (49%).

“Embracing these strategies can improve convenience and encourage more frequent purchases from the deli prepared section,” Stein said.

Beef up marketing. “There is a significant opportunity to build on marketing efforts to raise awareness of food-service options before shoppers enter the store,” Stein said. “While consumers already learn about offerings in-store, more than 60% also learn through other channels. Personalized marketing through social media, email or other digital tools can drive interest and keep food-service options top of mind as the consumer plans their shopping.”

Read more about:

OrganicAbout the Author

You May Also Like