8 methods natural products retailers can use to optimize private label sales8 methods natural products retailers can use to optimize private label sales

Sales of private label grocery products continue to grow—and not just a little. Find out why shoppers are increasingly turning to store brands for quality, taste and value.

December 10, 2024

At a Glance

- For the year ending June 30, one-quarter of all products sold at retail were private label.

- Of food retailers and manufacturers surveyed, 84% consider private brands to be very or extremely important to business.

- More than half the grocery shoppers surveyed say they are buying more private-label foods and beverages this year than last.

As an increasingly significant sector of the American grocery retail landscape, private brands are positively on fire. Across food, beverages, supplements, body care, home care and many other CPG categories, retailers’ own-label products are shedding their generic image, generating stellar sales and charting exceptional growth.

According to Circana data reported by FMI, the Food Industry Association, private brands accounted for 20.9% of total dollar sales across U.S. retail outlets in the year ending June 30. During the same period, private brands’ unit share reached 25.8%, which means that over one-quarter of all items sold at retail were store-branded products.

“While private brands were certainly on an upward trajectory before the pandemic, supply chain disruptions during the pandemic led to many shoppers trying private brands when the national brands were not available,” Steve Markenson, vice president of research and insights at FMI, said in October press briefing on part two of FMI’s The Power of Private Brands 2024 report.

Many consumers, pleased with the quality, value and lower prices of store brands, have stuck with these lines ever since. Rampant food inflation has also worked in private label’s favor. Per the latest Consumer Price Index, food-at-home prices have increased 24.8% since 2020.

Several other factors are propelling private brands’ assent—and compelling most food industry leaders to try to capture the windfall.

According to FMI’s latest survey of food retailers and manufacturers, 84% consider private brands to be very or extremely important components of their businesses. What’s more, a whopping 93% of those polled plan to moderately or significantly increase their investments into private brands over the next two years, up from 82% in FMI’s 2023 research.

“This commitment to increase investment also shows the ongoing confidence in private brands as a strategy,” Doug Baker, vice president of industry relations at FMI, said in the press briefing. “Obviously, they are performing exceptionally well. Some external factors have driven more customers to [private brands], but once they get to use them, they start to grow that trust in that brand as they had in others.”

Given consumers’ expanding embrace of store brands, Baker said retailers are setting ambitious goals to drive even more growth over the next two years. They are aiming to increase private brand dollar share roughly 4% and unit share about 3.5%.

Independent natural products retailers can absolutely capitalize on this trend. Whether a store is just now looking into launching a private label or wants to strengthen or expand an existing one, here are eight nuggets to know.

Doug Baker, vice president of industry relations, FMI; Steven Markenson, vice president of research and insights, FMI: and Taylre Stumpf, senior retail insights analyst, Kantar, spoke on private brand sales in an FMI seminar.

Almost all consumers purchase private labels

Earlier this year, FMI surveyed more than 1,500 U.S. grocery shoppers, sharing the findings in part one of The Power of Private Brands 2024. Turns out nearly all consumers—94% of those surveyed—purchase store brands at least occasionally.

This tracks very closely with national-brand buying patterns—for now anyway. With private label purchasing surging, that could change very soon.

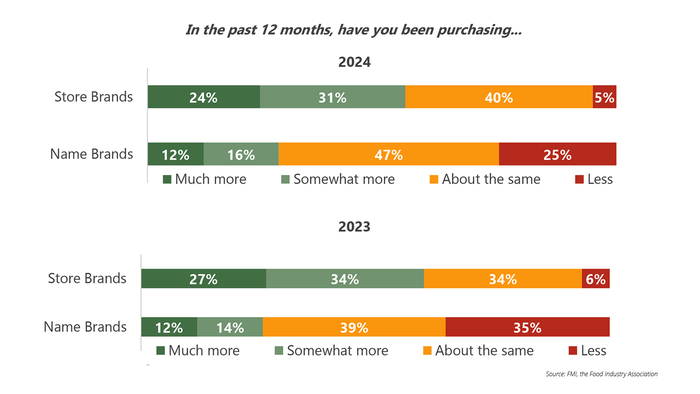

According to FMI’s shopper survey, 55% say they’ve been buying more store brands over the past year. As Markenson noted, this often comes at the expense of national brands. Indeed, just 28% of respondents reported purchasing more national brands over the last year.

At the same time, a mere 5% say they’re buying fewer store brands while 25%—five times as many—are purchasing fewer national brands.

“This trend is expected to persist,” Markenson said. “In our research, we’re seeing that almost half of all customers say they plan to further increase their private brands purchases over the next year.”

Private brands influence store choice

With their mounting popularity, private labels are having greater influence over where consumers opt to shop. In FMI’s consumer survey, 54% said store brands are very or extremely important in their choice of store. That’s a notable increase from 46% in 2019 and a giant jump from 35% in 2016.

Gen Z ‘hearts’ private brands

“Gen Z shoppers are increasingly opting for private-label products across a diverse array of categories, highlighting a significant and growing market opportunity for retailers,” says Taylre Stumpf, senior retail insights analyst at Kantar, a market research company.

In fact, Kantar’s ShopperScape data show that Gen Z shoppers are embracing store brands at a faster rate than older cohorts, Stumpf adds. “This upward trend not only signifies that Gen Z continues to place greater value on private-label offerings, but also underscores the imperative for retailers to strategically enhance their private-label portfolios,” she says.

Value, price, quality and taste drive store-brand buying

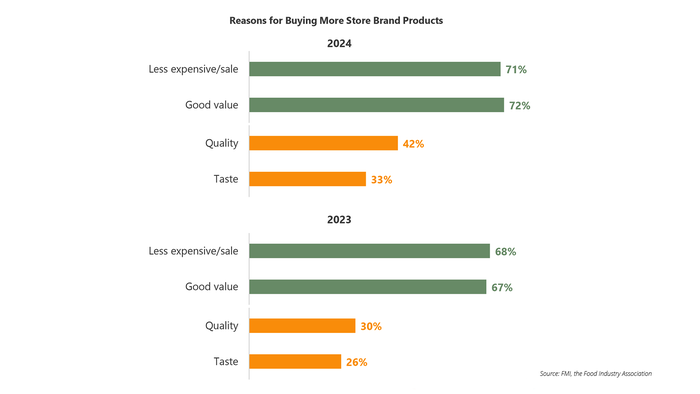

When FMI asked shoppers why they are purchasing more private label, better value and lower price emerged as the top two reasons, selected by 72% and 71% of respondents, respectively.

However, “the appeal of private brands goes beyond just affordability,” Markenson said.

Right behind price and value came quality, marked by 42% of shoppers, a significant rise from FMI’s 2023 survey, when just 30% of respondents named quality as a main motivator. Taste landed in fourth place this year, with 33%, up from 26% last year.

Digging into the top purchase drivers, FMI found that 71% of shoppers believe that private labels beat out name brands on price while 58% think private labels provide better value than name brands.

Among the respondents who reported purchasing more private label because of quality, over half (54%) perceive store brands to have “good enough” quality compared to national brands; 38% believe the quality is equal while 7% see store-brand quality as superior to that of national brands.

Innovation is the hot ticket

“Innovation is the key factor behind the success private labels are seeing today,” Stumpf says. “Private labels have evolved from being perceived as low-cost alternatives to becoming high-quality products that align with modern consumer demands—a transformation driven primarily by innovation.”

Particularly post-pandemic, retailers have “taken a leadership role in retail innovation, developing cutting-edge products” and “becoming the key differentiator between retailers,” Stumpf says. “Today, private labels function as specialty brands that offer flavors and options that national brands have yet to explore, or the white spaces. They are paving their own path, distinct from national brands.”

To illustrate, Stumpf points to frozen pizza. Beyond traditional options like cheese or pepperoni, shoppers can now find private-label offerings such as prosciutto and arugula pizza or wood-fired mushroom and truffle pizza, she notes. Plus, these pies are at price points similar to lower than most national brands’ pizzas. “This variety makes the choice easy for shoppers seeking something new with restaurant-quality taste at a fraction of the price,” Stumpf says.

Baker shared similar sentiments in the FMI press briefing. “Consumers have given private brand[s] permission to innovate,” he said. “This is really crucial to staying more competitive as we move forward.”

Transparency is critical

Beyond innovation, transparency around ingredients, sourcing practices, nutritional content and health attributes is a “crucial element in the success of private labels,” says Stumpf.

This is because today’s consumers today are increasingly health conscious and environmentally aware, she adds. They are also meticulous label readers.

Value add or bust

“Offering products that are equivalent to national brands in terms of features and quality, without additional value, may not entice consumers to switch,” Stumpf says. As such, value-added attributes are clutch.

“Private labels should offer unique selling points, such as health-oriented features (i.e., organic, non-GMO, plant-based, allergen-free) or local sourcing,” Stumpf says. “For instance, H-E-B’s success with its Texas Proud line demonstrates how emphasizing locally sourced products can resonate with regional consumers and differentiate the brand.”

Customer conversations help identify gaps and opportunities

For retailers who’d like to elevate their existing private brands program but aren’t sure how or where to expand, Baker suggested having in-depth conversations with customers. Discover what, where and how they enjoy eating, which flavors they crave, etc.

“Then start looking outside of the box to understand how private brands can serve that need,” Baker said. “Private brands need to make people’s lives easier just like every other brand in the store. So, building that relationship with your customer and understanding how you can do that is going to be where private brands can really innovate.”

About the Author

You May Also Like