The State of Natural Beauty: Consumers seek innovation, sustainability, quick routinesThe State of Natural Beauty: Consumers seek innovation, sustainability, quick routines

Get the latest data on natural beauty sales and trends, as well as examples of products that fulfill consumers' demands and environmental ideals.

The beauty and personal care space is an electrifying part of the natural products industry, with brands leading the way in innovation and beauty shoppers being some of the most engaged.

Personal care and beauty is a $51 billion industry that's growing 5.4%, according to Alice Mintz, director of integrated solutions at DAAP, a SPINS subsidiary. Natural, in particular, is driving 21% of beauty's growth, which is an overcontribution relative to its 8% industry share. Industry experts shared data, trends and more during "The State of Natural Beauty" panel discussion at Expo West.

Brands are also making a conscious effort to market products for all. Beauty, particularly in the natural space, is becoming more inclusive regarding gender, race, age, socio-economics and skin type, increasing accessibility for all.

Many consumers look to natural and specialty retailers to stock clean beauty products. Jocelyn Lyle, senior vice president of development and partnerships at Environmental Working Group (EWG), shares that 75% of Americans believe toxic chemicals in personal care products are a severe threat, according to a recent EWG poll. That number increases to 84% among women under 50. EWG also found that 71% of household purchasers prefer to shop for personal care in-store instead of online.

Social media platforms such as TikTok and expanded online resources make consumers more educated than ever. As a result, there is a purchase influence cycle where a consumer will learn about a product and the effects of a particular ingredient, which drives them to the store to test a product and look closely at the ingredient list for themselves. Consumers know what desired results to expect. Efficacy and transparency will be key to getting a product off the shelf and integrating it into their routine. As Mintz predicts, "Natural will transform the beauty industry at a faster rate than we experienced with food and beverage." On the left, you can see that ACURE utilizes TikTok to demonstrate how to use its new sustainable powdered mask and the ingredients behind it.

Cultural forces are driving the trends outlined below. Each trend is a response to society's desire for holistic health and well-being, purpose-driven innovation and to meet modern life.

Skincare as makeup

One of the beauty trends New Hope Network is seeing is the barefaced look and coquette makeup—think romantic with light pink shades, softly blended and a dewy, luminous look. These looks are light and require only a few products.

Simplicity is essential, and when wearing makeup, people want it to do more and be beneficial. Hybrid products such as Mineral Fusion's 2-in-1 Lip & Cheek Stain help simplify a routine and ease paring down the number of products in one's bag. The brand's Sheer Moisture Lip Tint provides a beautiful color with benefits. It hydrates and firms from ingredients such as shea butter and peptides.

Another example is Babo Botanicals' Daily Sheer Fluid Tinted Mineral Sunscreen can also be used as a primer base. It is lightly tinted, suitable for multiple skin tones and hydrating. The ingredient list contains upcycled passion fruit seed oil sourced from a family-owned farm in Peru, organic raspberry oil, and sweet white lupine for blue light protection. From Pacifica's Kind Glaze, skincare meets makeup in this dewy illuminator that supports a healthy skin barrier. Ceramide NP, vegan collagen and vegan squalane all hydrate the skin and lock in moisture.

Skinimalism and shortened personalized routines

In addition to minimal makeup, consumers are cutting down on their skincare routines. The goal is to find a simple, personalized routine best suited to their skin needs. Many took the time to practice multi-step and intensive skincare routines during the pandemic quarantine. Now though, people are going back out and getting busier. They want a simplified routine with minimal products, hence a call back to hybrid products where they can get more out of one product instead of needing two. It is all about a return to quality over quantity.

Pictured, HiBAR's solid face wash line offers different solutions based on your skin's need and specific PH balance.

Shorter and cleaner ingredient lists

A product does not need a complex list of ingredients to stand out. The ones with "-less" are making bigger impacts. The search for shorter, simpler lists and fragrance-free products continues to rise. Consumers know more about the science of certain ingredients and what works best for their own skin. They can easily sort through the noise and are paying attention to the quality of ingredients and efficacy of a product.

A product does not need a complex list of ingredients to stand out. The ones with "-less" are making bigger impacts. The search for shorter, simpler lists and fragrance-free products continues to rise. Consumers know more about the science of certain ingredients and what works best for their own skin. They can easily sort through the noise and are paying attention to the quality of ingredients and efficacy of a product.

Pictured, these products in stick formats are easy for consumers to incorporate into their routines. Both Andalou's new Dark Spot Corrector (left) and Pacifica's Wake Up Beautiful Balm (right) boost trending plant-based ingredients.

Consumers are seeking more haircare options

People want every part of their personal care routine covered from the tip of the toe to the top of the head. SPINS reports that natural personal care has accelerated 10% in the past year, with haircare, particularly, seeing the most significant subcategory growth at 2% compared to the past two years. In the past two years, haircare had a 3% sales increase, which was larger than the sales growth for bath and body, skincare, oral care and suncare.

Pictured above from left to right: Kitsch Scalp Oil, BRIXY Solid Shampoo, Nfuse Revive Scalp Serum

Sustainability

Consumers are still demanding clean, safe and natural formulations but now are pushing manufacturers a step further with sustainability. They are actively looking for compostable and refillable packaging. While beauty aisles have traditionally been flooded with plastic and bulky packaging lining the shelves, natural is pushing the needle forward.

Natural beauty and personal care innovators are leading in eliminating plastic and developing sustainable solutions like waterless formulas. Removing water from a product, concentrating it and ridding packaging of unnecessary plastic have been building momentum for some years. As a result, these products ship lighter, have a lower carbon footprint, preserve resources and have a smaller footprint on retail shelves. Expo West exhibitors presented new brands such as BRIXY bringing consumers more waterless, solid personal care options, allowing hydrating ingredients like coconut oil, cacao seed butter, argan oil, shea butter and provitamin B to not be diluted. Spinster Sisters Co. won the NEXTY Award for Best New Personal Care or Beauty Product with its Hyaluronic Acid + Vitamin C Face Serum Stick. Acids continue to be a trending ingredient, with hyaluronic acid showing a 25.6% increase in attribute dollar sales over the past two years. Retinol saw a 31.9% increase, and bakuchiol sales grew 15.6%. When it comes to acids, "Consumers are not afraid to layer, experiment and cycle," Mintz says.

Other products shown include LastObject's LastSwab Reusable Beauty Trio, which eliminates the need for single-use cotton swabs. Each tip has a specific shape/texture for different beauty applications in a convenient travel case. ACURE is a stalwart brand innovating and pushing for sustainable beauty with waterless formulations in paperboard packaging. Like Spinster Sisters' serum stick, ACURE's new Brightening Eye Serum Stick comes in an easy-to-apply stick format packaged in a compostable tube.

Trending ingredients include plants and botanicals. According to SPINS, aloe vera, tea tree oil for hair care and colloidal oatmeal all saw significant increases in sales over the past two years. Mayo of NIQ says the trending ingredients her company is watching include kale, rose oil, antioxidants, algae, ginger, sunflower oil, dandelion, plant-based protein and acai. She also shares that products free from aluminum, phthalates and sulfate are driving significant growth in personal care sales.

Education

Now is the time to be sharing more with a potential purchaser. Take advantage of not only packaging to tell a brand's story but also websites and social media—demonstrations on new delivery formats via social media videos and posted reviews about product efficacy are where many consumers go for discoveries. Consumers are likely to check multiple channels before purchasing a new beauty product.

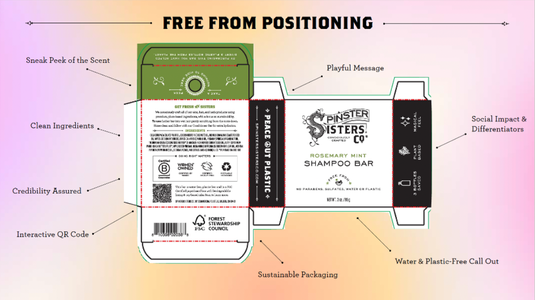

Design space is limited on packaging, especially for beauty, as products tend to be smaller. Above is a great diagram from Spinster Sisters Co. on the key points to include when using packaging to share a product's sustainability positioning. NIQ reported that in the last year, "greenwashing" ranked as the sixth most-mentioned topic by those who posted about clean ingredients on Instagram, which tells us that consumers are following up on claims and verifying that brands are taking the actions they say they are. The top five topics mentioned last year were non-toxic, natural formulations, renewable energy, conscientious and recycling, showing that clean beauty enthusiasts are very interested in sustainability claims. They want their dollars to support every step of a sustainable and ethical manufacturing process.

Tips for moving forward

Whether embracing one or multiple of the trends mentioned above, Mintz of SPINS shares some final advice for brands:

1. Build trust with certifications

Help consumers identify products aligned with industry expectations.

As Lyle of EWG points out, third-party validation matters. EWG's recent polling found that 75% of household purchasers are interested in third-party certifications. Over 50% of household purchasers use third-party certifications at least sometimes to find safer products, and 52% of millennials and Gen Z are aware of EWG VERIFIED.

NIQ data shows that clean and cruelty-free are top characteristics among both younger and older generations driving their beauty purchases.

SPINS data shows the following sale increases over the past two years: +41.5% for Certified B Corp (particularly in hair care), +29.7% for products labeled aluminum free and +20.7% for products labeled organic (again, particularly in hair care).

2. Lead with incremental innovation

Make new products approachable to the curiously cautious consumer.

3. Efficacy rules the routine

Affirm the position that natural products can equate to high performance.

About the Author

You May Also Like