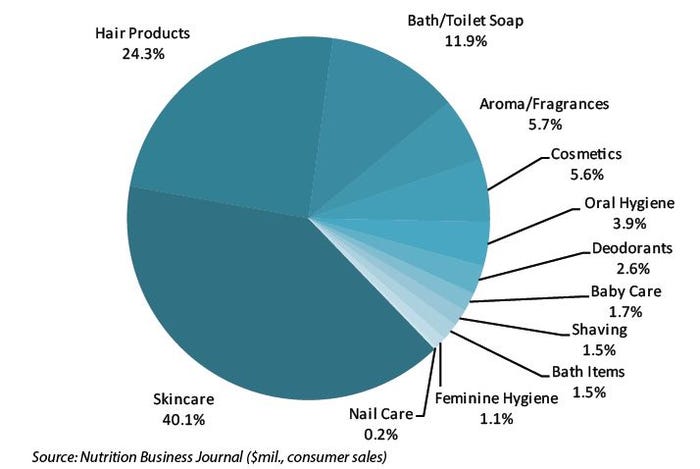

Growth in the U.S. natural and organic personal care market has slowed from booming growth earlier this decade, but is still a strong industry at an estimated $14 billion in annual sales in 2017. The largest category by sales in the U.S. natural and organic personal care market is skin care, with an estimated $5.6 billion in annual sales in 2017 and 40.1 percent market share. As interest in "beauty from within" grows, consumers are looking to streamline their personal care regimens and seek out multifunctional products.

The increasing discussion around self-care has influenced consumer purchasing in personal care. Products such as bath salts and face masks, both driving growth, provide consumers with a small break and opportunity for self-care. The strongest estimated growth in 2017 came from bath items at 12.5 percent, largely driven by growing sales of bath salts.

Interested in the natural and organic personal care market? NBJ's Personal Care Data Guide is available for purchase here.

Interested in the natural and organic personal care market? NBJ's Personal Care Data Guide is available for purchase here.

About the Author

You May Also Like