States of Good Food Report: Natural continues to set the paceStates of Good Food Report: Natural continues to set the pace

This piece is part of the Good Food Insights series—a collaboration with FamilyFarmed’s Good Food Accelerator and Naturally Chicago programs, Esca Bona, and SPINS—that unpacks the dynamics driving the good food movement.

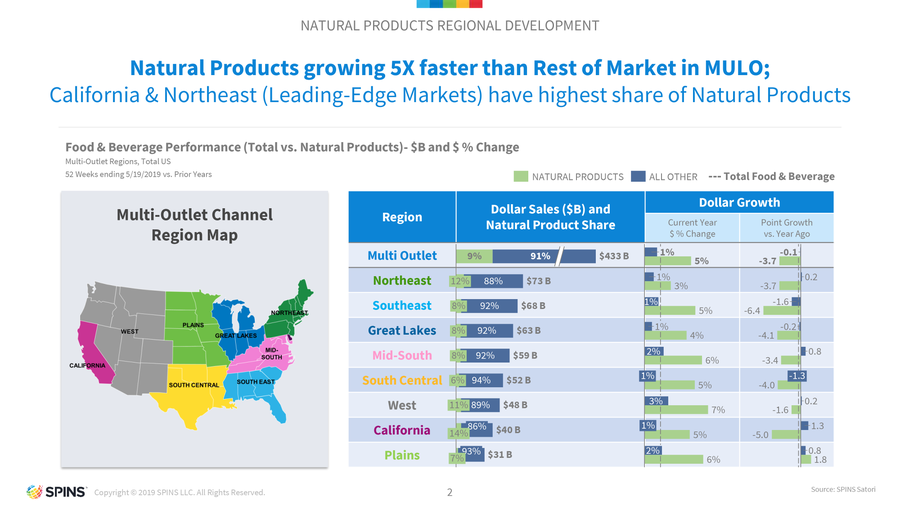

Here’s some good news for natural products marketers and advocates: Natural product sales are growing five times faster than conventional product sales nationally—in the Multi-Outlet (MULO) channel, a.k.a. traditional grocery chains.

Here’s the even better news: Natural product growth in this channel, where the vast majority of Americans get their groceries, outstrips conventional growth in all seven regions of the United States (as defined by SPINS, the leading wellness-focused data technology company for the natural, organic and specialty products industry, and a partner in this Good Food Insights series).

These are the headlines from our annual States of Good Food Report, based on SPINS’ analysis of MULO market data for the 52 weeks ending May 19, 2019. This follows upon the first annual report published as part of the Good Food Insights series in July 2018.

Natural products sales still have tremendous room for additional growth. Even with the rapid rise of consumer interest in this sector, it makes up 9% of total sales in the MULO channel.

Still, natural products sales in the MULO channel grew by 5% over the study period to 1% for conventional products. Conventional retailers are recognizing that the rise of natural is an ongoing historic and generational shift, not a fad (as some formerly tried to dismiss it). And as they address consumer demand by adding more natural products to their shelves, they are jump-starting further growth in the sector.

“Increasingly, conventional retailers have really robust natural assortments,” said Andrew Henkel, senior vice president of brand growth solutions at SPINS, who also noted that conventional retailers, with their enormous volume, are the biggest sellers of natural products. (It has long been common knowledge in the industry that Walmart and Costco compete head-to-head as the leading retailers of organic food.)

Not that there is a completely level playing field from sea to shining sea. “That assortment has definitely lagged in some parts of the country in terms of availability of natural products,” said Henkel, which helps explain why natural’s share of total MULO sales is 14% in California compared to 6% in the South-Central states. But Henkel added, “I take heart in the fact that as we look across the board at the growth rates, you see consistent growth rates by region.”

Here is how all the regions stack up in terms of natural MULO market share (see map graphic for the states included in each region):

California: 14%

Northeast : 12%

West (excluding California): 11%

Southeast: 8%

Great Lakes: 8%

Mid-South: 8%

Plains: 7%

South-Central: 6%

Henkel noted that the forerunner regions have the biggest consumer bases that are apt to adopt a good food and natural products lifestyle. “Parts of the country that have a significant urban, progressive consumer bases are indicators of where the rest of the country is going to go,” he said.

Yet some of the regions that have lower overall natural sales are playing catch-up in terms of growth (conventional sales growth numbers are in parentheses for comparison):

West: 7% (3% conventional)

Mid-South: 6% (2%)

Plains: 6% (2%)

Southeast: 5% (1%)

California: 5% (1%)

South-Central: 5% (1%)

Great Lakes: 4% (1%)

Northeast: 3% (1%)

These robust numbers and differentials are despite that fact that these natural growth rates are down from the exceptional performance over the year ending May 2018. Growth in the Southeast has slowed by 4 percentage points in the past year; California’s growth has decelerated to 5% from 10% last year.

Expanded disruption in conventional product sectors—something experienced most profoundly so far with plant-based alternatives to meat and dairy—is needed to ensure that these growth rates are maintained and accelerated. “There are a lot of untapped spaces in the store that could use natural revitalization,” Henkel said. “Some brands are disrupting traditionally conventional spaces, but there's a lot of room for continued innovation.”

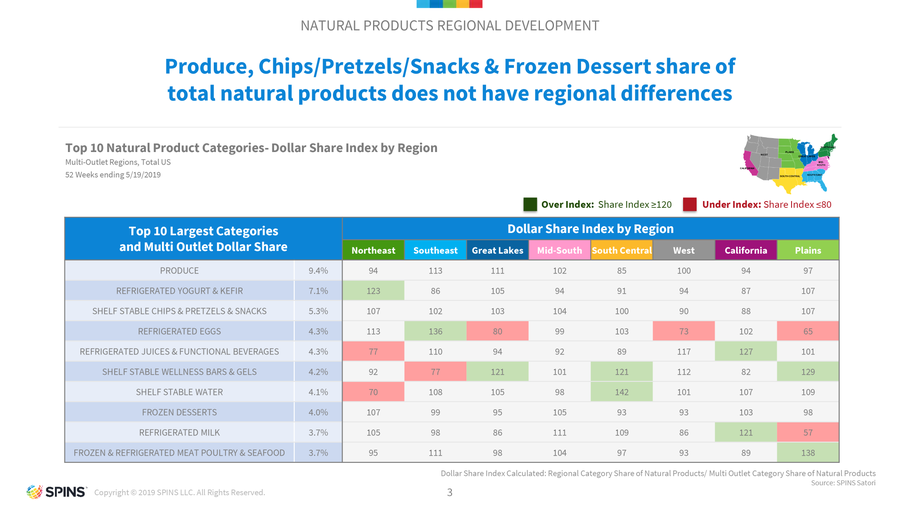

SPINS’ drilldown on what kinds of natural products are best sellers shows no big shocks at the top. Produce is the leading natural category with 9.4% of natural products sales. Eating more fruit and vegetables is the first thing most people think of when it comes to healthier eating.

Refrigerated yogurt and kefir ranks No. 2 at 7.1%, reflecting two consumer trends, an interest in gut health and lifestyles that lend themselves to grab-and-go snacking. According to Alice Mintz, senior manager of SPINS’ strategic partners group, “Yogurt is a large category and was one of the first to be disrupted in a big way by natural and specialty brands … Greek yogurt brought a health halo to the category, with high protein content, probiotic presence and lower sugar content than conventional brands. Today, dairy faces significant headwinds, but the emergence of plant-based yogurt has assisted in the category maintaining relevancy.”

Ranking third at 5.3% are shelf-stable chips, pretzels and snacks. These products make for an easy gateway for many people to move toward a healthier diet, as they seek more natural alternatives to products that have long been portrayed as “junk food.” Mintz sees a comparable phenomenon in the frozen desserts category (ranking eighth at 4% of total MULO natural products sales), “where we see big CPGs innovating with plant-based ice cream.”

The regional breakdown for these products varies, sometimes greatly, as measured by SPINS’ Dollar Share Index, which compares each category share of natural products in each region against the category national share. For example, there is no spread in that shelf-stable chips/pretzels/snack category. By contrast, refrigerated eggs’ share of natural products over-indexes in the Southeast and under-indexes in the Plains.

Good Food Insights will continue to highlight compelling individual categories, including in August, when we will take a look at kombucha and kefir. In the meantime, we’ll be doing all we can—with our personal grocery lists—to help natural products grow even faster.

Good Food Insights is an editorial partnership of New Hope Network’s Esca Bona thought-leadership platform; FamilyFarmed’s Good Food Accelerator and Naturally Chicago programs; and SPINS, the leading wellness-focused data technology company for the natural, organic and specialty products industry. Good Food Insights articles provide timely analysis of major trends and innovation in the national good food landscape.

About the Author

You May Also Like