Monitor: Trending ingredients not the biggest opportunity of the 'Ozempic Age'Monitor: Trending ingredients not the biggest opportunity of the 'Ozempic Age'

Sales of individual ingredients such as berberine don't grow the weight management supplement category, but the revolution in pharmaceuticals still holds promise. Learn more.

At a Glance

- Although berberine sales have surged, they still represent a tiny fraction of the weight management supplement market.

- Nutrition Business Journal’s new report shows steady sales growth, but not a spike, in weight management supplements.

As soon as the first before-and-after celebrity photos began circulating and Ozempic became synonymous with weight loss, it was inevitable that supplement ingredients would be scrambling for a place on pharma’s coattails. TikTok chatter about ingredients like berberine, which caught fire as “nature’s Ozempic,” may overstate the impact on the weight management supplements category, according to findings in the upcoming Supplements in the Age of Ozempic Special Report from New Hope Network's Nutrition Business Journal.

The report shows an uptick in growth for weight management supplements, but not the kind of dramatic spike in sales an observer might infer from an ingredient like berberine. NBJ estimates sales of the botanical compound grew a stunning 99% in 2023, but that translates to a gain of just $7.5 million, taking berberine total sales to $15 million. The 64.4% growth predicted for 2024 notches the berberine market up to $24.7 million, an impressive gain from sales of $6.1 million in 2019. However, berberine represents just 0.3% of the weight management supplement market. Other ingredients, like both pre- and probiotics, are showing big accelerations in sales since Ozempic and other GLP-1 drugs shined a new light on the category. Still, the impact has not been huge on overall sales for weight management supplements, which are predicted to see 6.7% growth in 2024, not remarkably higher than the 6.3% in 2019—before anyone had heard of the GLP-1 drugs.

The fact that the weight management supplements market is overwhelmingly dominated by meal replacement shakes means sales of individual ingredients like berberine often do little to move the broader market. On its own, meal replacements represent 70% of weight management supplement sales. Growth for meal replacements has also picked up as Ozempic and other GLP-1 drugs have renewed interest and confidence in weight management, but that growth is incomparable to growth in sales of the GLP-1 drugs, which are on their way to passing $100 billion in yearly U.S. sales by 2030.

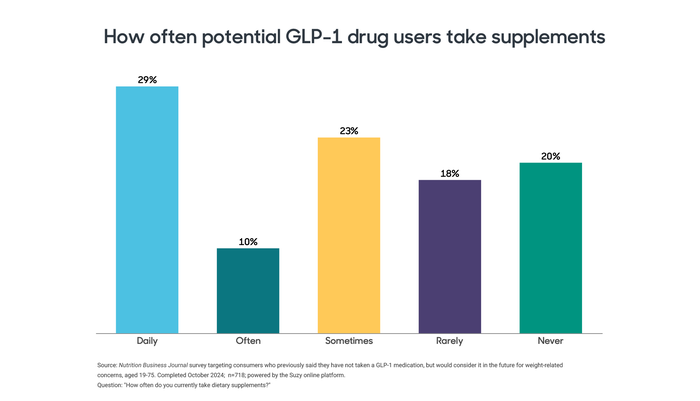

None of this means that the GLP-1 drugs haven’t changed the game for weight management supplements. NBJ still expects a cycle of fad-drive sales spikes that are often as short as they are hot, but the broader opportunities in the Ozempic age could be a break from that age-old pattern. At some point, there will be millions more ex-Ozempic users than current Ozempic users and they will be looking for ways to keep the weight off. That could mean products that aren’t screaming “lose weight fast!” but instead focus on healthy weight maintenance and all the lifestyle changes that go with that—goals that the supplement can reasonably and effectively claim to help consumers meet.

Learn more about the weight management supplement industry in light of the "Ozempic Age" in Nutrition Business Journal's Supplements in the Age of Ozempic Special Report.

About the Author

You May Also Like