Monitor: Natural shoppers care how meat's produced but have room to growMonitor: Natural shoppers care how meat's produced but have room to grow

New research reveals which attributes consumers care about when shopping for meat and poultry.

When you look at Beyond Meat’s stock price dropping to $10 on May 16 from nearly $235 in July 2019, it’s tempting to say that meat eaters can't be moved away from eating animal-based burgers and sausage. The challenge for the natural products industry, however, might be more about what those meat eaters are looking for—and how to serve it responsibly.

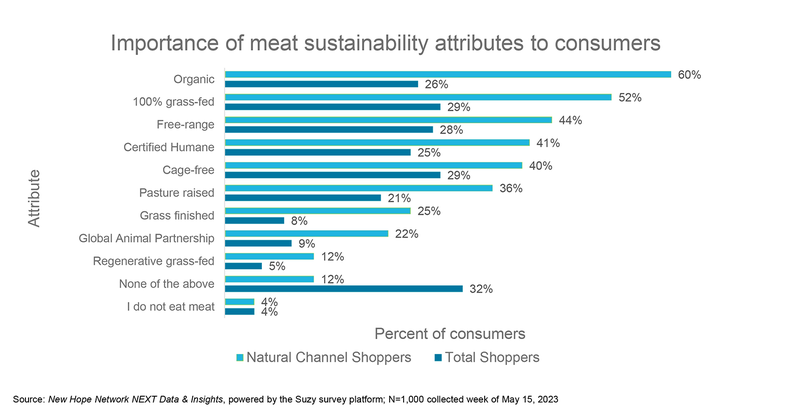

In new research from New Hope Network's NEXT Data & Insights team, we learn that not all consumers are looking closely at how their meat and poultry is produced, but the ones who do are keying in on certain key attributes. For starters, only 43% of natural channel consumers say they pay attention while grocery shopping to how their meat and poultry is produced. The number for all shoppers was remarkably lower, at 27%. But when asked what attributes they care about, the percentages are more encouraging.

For natural channel shoppers, organic garnered the most positive responses, with 60% calling that attribute important. The number of people who said they care about "grass-fed" meat was also above 50%. The now-familiar term "cage-free" was cited by 40%, but the fact that "pasture raised" was important to 36% suggests that shoppers might be raising their expectations.

Other attributes were not as important to respondents. That only 12% of natural channel shoppers noted "regenerative grass-fed" as important tells us there is a lot of work to be done on raising awareness of regenerative agriculture.

All those percentages are lower for total shoppers, which includes natural channels shoppers—the 32% who responded "none of the above" is particularly shocking—but the mission of the natural products industry is to move the market toward a more responsible model. Some of those steps might be incremental: "Cage-free" and "free-range" are steps along a path and the 36% of natural shoppers who indicated that "pasture-raised" is important reveals how far consumers have come.

Incremental steps still lead somewhere.

Bigger steps made more quickly are more difficult. It's possible the alternative-meat movement moved too quickly for the market, as the Beyond Meat stock collapse suggests. Much of that, undoubtedly, comes down to irrational investor exuberance and some backlash when questions emerged about how healthy the products are. The Washington Post Editorial Board on May 12 labeled meat alternatives a fad and expounded on why that fad has "sizzled out."

The question for the natural products industry might not be whether The Washington Post is wrong, but rather, what the industry should be doing to draw more consumers along that path toward more responsible meat, whether it's real or alternative.

A path, we can assume, that is paved in incremental steps.

About the Author

You May Also Like