Organic produce sales higher than normal amid coronavirus outbreakOrganic produce sales higher than normal amid coronavirus outbreak

Dollar and unit volume jump by more than 20% during March.

April 17, 2020

Americans have boosted purchases of organic fruit and vegetables as they hunker down during the novel coronavirus (COVID-19) pandemic.

U.S. organic fresh produce sales jumped 22% in March and 8% overall for the first quarter “in retail conditions unlike any ever experienced in the modern era of grocery retailing,” according to the “2020 Q1 Organic Produce Performance Report,” released by the Organic Produce Network and Category Partners.

Monterey, Calif.-based Organic Produce Network said “unprecedented consumer purchasing behavior” because of COVID-19 emptied store shelves across the country, creating out-of-stock conditions. In March, total organic dollar sales climbed 22.1% year over year and dwarfed the 1.8% increase in the January/February period. Likewise, organic produce volume surged 25.8% in March versus 4.1% in January/February.

Data show organic fruit and vegetables outperformed conventional produce in March as well as in the first quarter, the Organic Produce Network noted.

Conventional fruit and vegetable sales rose 20.7% in dollars and 22% in volume for the month, compared with growth of 0.3% in dollars and 1.2% in volume for January/February. In the quarter, dollar sales advanced by 6.6% and volume by 7.7% for conventional produce. Meanwhile, organic produce sales were up 8% in dollars and 10.7% in volume for the quarter, versus gains of 6.6% in dollars and 7.7% in volume for their conventional counterpart.

The 2020 Q1 Organic Produce Performance Report examined Nielsen retail scan data covering total food sales and outlets in the United States over the past 13 weeks, including a deeper analysis of March sales results. March 2020 organic fresh produce sales totaled $546.8 million, while in the first quarter organic fresh produce sales topped $1.58 billion.

“Organic fresh produce sales in the first quarter of the year were strong, and the impact of COVID-19 in March pushed numbers even more,” Matt Seeley, CEO of the Organic Produce Network, said in a statement. “We continue to see organic fresh produce sales outpace the dollar and volume growth rate of conventional fresh produce.”

Organic Produce Network

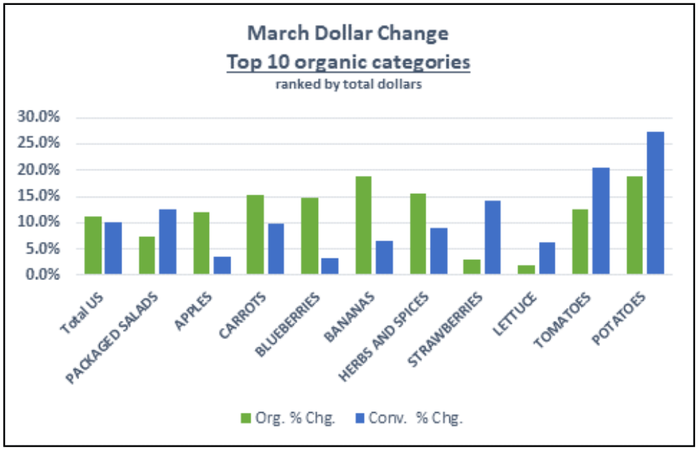

Organic bananas, blueberries, carrots and herbs and spices all saw dollar sales increases higher than the conventional versions of those products.

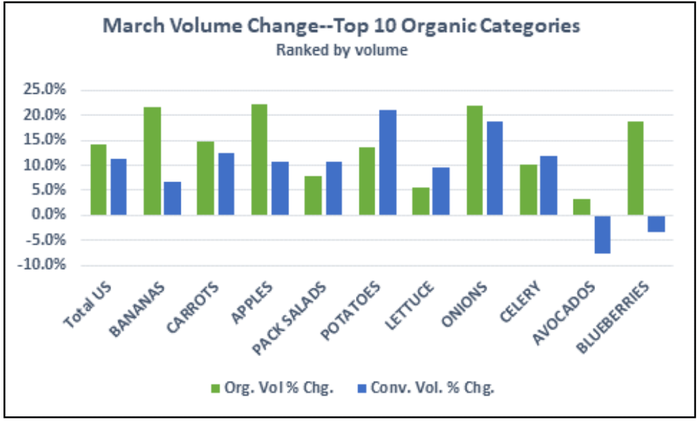

In March, the top five organic produce categories by dollar sales growth were bananas, potatoes, herbs and spices, carrots and blueberries. The unit sales leaders were apples, onions, bananas, blueberries and carrots.

The study pointed out that, during March, both organic and conventional produce departments were hit by consumer pantry-loading buying behavior as the spread of COVID-19 intensified.

“As we saw in many supermarkets in March, consumers swept into stores exhausting supplies, starting first with staples. In many stores, this created out-of-stock conditions forcing consumers to make second-choice purchase decisions,” the report explained. “In conventional produce, broad assortment and deep inventories allow shoppers to select alternative varieties or packages if the preferred item is sold out. For organics, supermarket assortment and inventory are tighter and there are simply fewer choices. This means fewer second-choice organic selling opportunities for retailers and fewer alternatives for consumers if their preferred organic item had sold out.”

Organic Produce Network

Organic carrots, apples and onions all saw sales volume increases of more than 20% in March.

For the first quarter, packaged salads, apples and bananas generated the highest increases in organic dollars, accounting for more than 35% of total organic produce dollar sales, the Organic Produce Network said. By volume, the organic leaders were bananas, carrots and apples, which represented 44% of total organic unit sales, with bananas escalating by 19.5%.

“The West continues to be the strongest region in the U.S. for organic performance, with first-quarter 2020 ACV performance 34% above the U.S. average,” according to Seeley. The 2020 Q1 report indicated that the West and Northeast shared the biggest increase in organic dollars, though going forward the greatest opportunity for organic growth appears to be in the Midwest and South.

Organic dollar share expanded to 9.8% of total produce during the first quarter. However, production limitations that restrict retail distribution to a narrower mix of organic fruit and vegetables continue to impact the segment’s growth, the study said.

“What we see in the Nielsen data is that organic produce at retail is concentrated within fewer categories than conventional produce, especially in the winter months, when locally produced organic products are less available,” said Steve Lutz, senior vice president of insights and innovation at Category Partners. “The top 10 organic categories in produce drive 59% of dollars and 71% of volume in Q1. These same categories contribute only 42% of total conventional sales and 52% of volume.”

Organic produce’s standing in the minds of shoppers has been further elevated during the coronavirus crisis, Seeley added. “Consumers are looking for items they trust during these uncertain times,” he said, “and organic fresh produce is a healthy and safe option for all consumers.”

This piece originally appeared on Supermarket News, a New Hope Network sister website. Visit the site for more grocery trends and insights.

This piece originally appeared on Supermarket News, a New Hope Network sister website. Visit the site for more grocery trends and insights.

About the Author

You May Also Like