Sales of organic products grew 11 percent in 2015 — more than three times faster than the overall food market's growth — to set a new record.

May 19, 2016

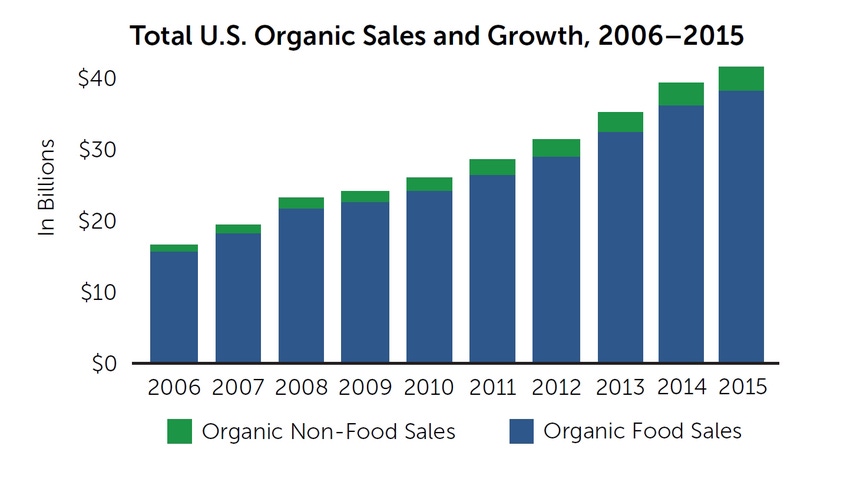

Total organic product sales in the United States hit a record high of $43.3 billion in 2015, an 11 percent increase from 2014, according to the Organic Trade Association’s 2016 Organic Industry Survey. That organic growth rate more than tripled the overall food market's growth of 3 percent.

The industry saw its largest-ever annual dollar gain in 2015, adding $4.2 billion in sales, up from the $3.9 billion in new sales recorded in 2014.

Of the $43.3 billion in total organic sales, $39.7 billion was organic food sales, up 11 percent from the previous year. Non-food organic products accounted for $3.6 billion, up 13 percent.

Nearly 5 percent of all the food sold in the U.S. is organic, the survey found.

This significant growth came in a year during which supply issues persisted to dominate the industry, as organic production in the U.S. lagged behind consumption. In response, the organic industry came together in creative and proactive ways to address the supply challenge, improve and develop infrastructure and advocate for policy to advance the sector.

“The industry joined in collaborative ways to invest in infrastructure and education, and individual companies invested in their own supply chains to ensure a dependable stream of organic products for the consumer. Despite all the challenges, the organic industry saw its largest dollar growth ever,” said Laura Batcha, OTA CEO and executive director.

Produce the gateway to organic

Organic produce retained its longstanding spot as the largest organic category with sales of $14.4 billion, up 10.6 percent. Almost 13 percent of the produce sold in this country is now organic.

Dairy, the second biggest organic food category, accounted for $6.0 billion in sales, an increase of more than 10 percent. Dairy accounts for 15 percent of total organic food sales.

“Whole foods – produce and dairy – are driving the market. Together, they account for more than half of total organic food sales,” Batcha said. “The organic market looks like a healthy plate.”

The demand for fresh organic was most evident in fresh juices and drinks, which saw explosive growth of 33.5 percent in 2015.

The fastest-growing organic category was condiments, which for the first time crossed the $1 billion mark in sales with 18.5 percent growth.

Consumers are not just eating organic, they are incorporating more organic into their total lifestyle, and organic non-food products continued to gain in popularity.

Even though non-food products account for just 8.2 percent of overall organic sales, sales growth of organic non-food products reached almost 13 percent. Comparable, primarily conventional, products saw sales growth of 2.8 percent. Growth in the non-food category was led by organic fiber, followed closely by organic supplements.

More accessible, but challenges persist in supply chain

Increased consumer demand for organic products in 2015 also can be attributed to greater access to these products at mainstream retailers, including supermarkets, big box stores, membership clubs and other outlets.

Growth did not come without continued challenges to the supply chain. Dairy and grains were two areas in which growth could have been more robust in 2015 if more supply had been available. The industry understands the need to build a secure supply chain that can support demand. This goes hand-in-hand with securing more organic acreage, developing programs to help farmers transition to organic and encouraging new farmers to farm organically.

Some companies are dealing with these supply issues individually, while others are collaborating on them. U.S. Organic Grain Collaborative members include Annie’s, Stonyfield, Organic Valley, Clif Bar, Nature’s Path, Grain Millers and more. On the fiber side, 2015 saw the creation of OTA’s Organic Fiber Council, whose members come from across the organic fiber industry, to focus on increasing awareness of the benefits of organic fibers and encouraging more organic cotton acreage in the U.S.

Despite strategic challenges, Batcha is confident about the industry’s future prospects.

“Organic is a bright spot in agriculture and the economy of America. Our success will continue to be built on a solid foundation of stakeholder engagement, transparency and meaningful organic standards that consumers trust in,” she said.

OTA’s 2016 Organic Industry Survey was conducted and produced on behalf of OTA by Nutrition Business Journal (NBJ). The survey was conducted from Jan. 7 through March 25. More than 200 companies responded to the survey.

Executive summaries of the survey are available upon request. The full report can be purchased here.

You May Also Like